AQA AS ECONOMICS: Unit 2 The National Economy SECTION B Part 2

Unemployment

Assignment Extracts D, E and F, and then answer all parts of Part 2 which follow.

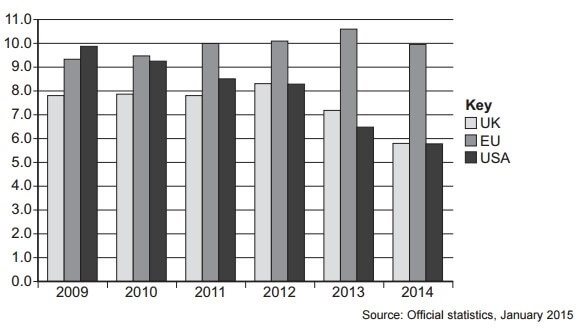

Extract D: The rate of unemployment (%) in the UK, EU and USA, 2009 to 2014

Extract E: Is the UK close to achieving full employment?

During the past year, unemployment in both the USA and the UK has fallen rapidly but in the EU as a whole unemployment remains stubbornly high. The unemployment rate in both Greece and Spain is well over 20%, although in Germany and Austria the unemployment rate is low at around 5%.

Job vacancies in the UK have risen to their highest level in 14 years and, at 5.8%, the unemployment rate is the lowest it has been since the middle of 2008. Some economists have warned that the high number of vacancies could signal a mismatch between the type of jobs available and skills of those who are seeking work, with firms struggling to recruit the right workers. Some construction companies have been recruiting bricklayers from Portugal and, in some regions, the NHS is struggling to find qualified nurses and doctors.

Recent data suggest that further reductions in unemployment may be accompanied by rising wages. After a number of years when pay rises have been below inflation, the past few months have seen real wages start to increase.

During the past 12 months, average earnings have risen by 1.8%, faster than the 0.5% CPI inflation rate. Companies have expressed concerns about skill shortages, indicating that there is less spare capacity in the UK economy than some economic forecasters have suggested.

In March 2009, the Bank of England cut Bank Rate to 0.5%, the lowest rate of interest it has ever set. Bank Rate has remained at this record low level ever since. The Bank has also used a number of other monetary policy measures, such as quantitative easing, to encourage banks and other financial institutions to increase their lending to firms and households. Expansionary monetary policy has undoubtedly contributed to the fall in unemployment and the recovery of the UK economy.

Although monetary policy has encouraged spending by the private sector, many believe that cuts in government spending have delayed the recovery in the economy. However, now that unemployment has fallen to levels not seen since 2008, fiscal measures designed to increase incentives and help people to return to work are viewed by some as the only way to reduce unemployment further without an unwelcome rise in inflation. Falling oil and commodity prices have led to a temporary reduction in inflation and should help to boost short-run growth, but these price reductions are unlikely to continue.

Persistently slow growth in Europe and a strengthening of the value of the pound against the euro have led some to predict that the fall in unemployment in the UK will soon come to an end. In January 2014, a pound bought €1.20 whereas in January 2015 a pound was worth €1.33. Many UK businesses are already struggling to export to Europe and a stronger pound will not help.

Q.5. Define the term ‘unemployment rate’ (Extract E).

Answer: Unemployment rate is a measure to calculate the unemployment in the country. It is percentage of total workforce which is unemployed and is actively seeking for a job. It is the number of people unemployed by the total workforce of the economy and it is expressed as a percentage.

Q.6. Using Extract D, identify two significant points of comparison between the rate of unemployment in the UK and the USA over the period 2009 to 2014.

Answer: The first significant point of comparison between the rate of unemployment in the UK and the USA over the period 2009 to 2014 is the year 2009. After the financial crisis in 2008, unemployment rate in USA was higher than that of UK. Also, following the next two years, UK unemployment rate remained at the same place whereas USA unemployment rate was decreasing.

Now, the second significant point of comparison is 2012-2013. In 2012, UK employment rate increased unlike its earlier trend and was equal to the USA unemployment rate. However, in 2013, USA unemployment rate fell more sharply than the UK unemployment rate. This year, UK unemployment rate was higher than that of USA.

Q.7. Extract E states: ‘Companies have expressed concerns about skill shortages, indicating that there is less spare capacity in the UK economy than some economic forecasters have suggested’. Explain how a sustained reduction in the amount of spare capacity in the UK is likely to affect inflation.

Answer: Spare capacity is situation where actual production is less than the optimal production of the companies. In case of spare capacity, firms have unsold goods, therefore, to improve cash flow they try discounting goods to sell excess supply of goods. As unemployment rises, it is harder for workers to bargain for higher wages. Unemployment should reduce wage inflation, which feeds into lower CPI inflation. A recession decreases the demand for goods and thus reduces the general price level. Also, there is low confidence in the economy which reduces inflation expectation.

Spare capacity can be helpful because it allows businesses to respond to short-term or an unexpected increase in demand, when there is some productive slack, supply is price elastic. It also gives time for maintenance, repairs and employee training. Thus, a sustained reduction in the amount of spare capacity will decrease the output gap, raising the aggregate demand and the level of prices rise. With the reduction in spare capacity, inflation increases.

Q.8. Extract F states: ‘Persistently slow growth in Europe and a strengthening of the value of the pound against the euro have led some to predict that the fall in unemployment in the UK will soon come to an end’.

Using the data and your knowledge of economics, evaluate the relative merits of monetary and fiscal policy measures for a government attempting to achieve a further reduction in unemployment in the UK.

Answer: Through expansionary fiscal and monetary policies, aggregate demand increases which will lower unemployment in UK. Thus, government should focus on such policies which will raise the aggregate demand.

EXPANSIONARY FISCAL POLICY:

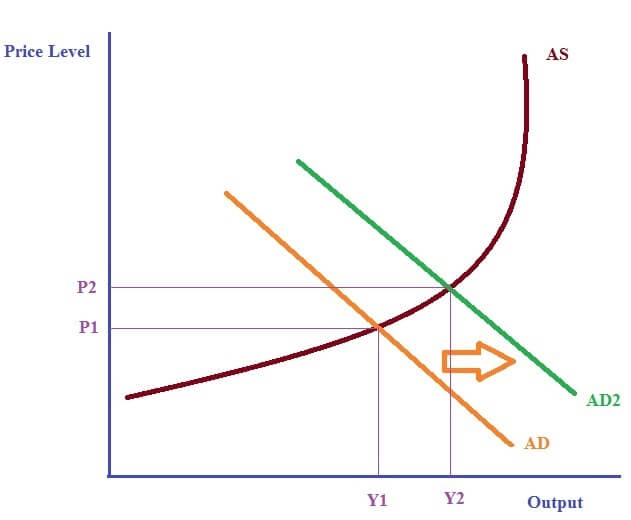

Expansionary fiscal policy is undertaken as a reaction to recessions or employment shocks so as to achieve growth in the economy through increase in government spending on infrastructure, education, and unemployment benefits etc. This also stabilizes the employment in the economy. The aggregate demand increases which shifts the AD curve to the right. And this is mainly done through increase in government spending or cut in taxes.

An increase in government spending directly affects the AD curve and on the other side, a cut in taxes will indirectly affect AD curve because consumers will have more money in their pockets after taxes.

Here, the economy is at point-A with Y1 level of output and P1 level of price. An expansionary fiscal policy shifts the AD curve to the right from AD to AD2 resulting in an output increase from Y1 to Y2 and increase in price level from P1 to P2.

The main rationale behind such policy is that with more government spending and cut in taxes, people will have more money in their hands which leads to more spending and creates demand resulting in business expansion and creation of more jobs. It helps in restoring consumers and businesses confidence.

If firms produce more, demand for workers and this lower demand-deficient unemployment. Also, with higher aggregate demand and strong economic growth, fewer firms will go bankrupt meaning fewer job losses.

EXPANSIONARY MONETARY POLICY:

Expansionary monetary policy focuses to increase aggregate demand and economic growth in the economy. This involves increasing the money supply or to cut interest rates which thus, stimulates economic growth. When the economy is set to grip in recession or there is a slowdown in economic activities, the central bank generally opts for expansionary monetary policy.

Expansionary monetary policy can take place through various ways like lowering interest rates because it will tend to reduce the incentive to save, making spending more attractive instead. These low interest rates reduce mortgage interest payments, increasing disposable income for consumers. Similar change in aggregate demand happens as in case of expansionary fiscal policy.

Expansionary monetary policy leads to infusion of more money in economy which increases the supply of money in the economy. The cost of money i.e. interest rate decreases and due to decreased interest rates, lending activity increases. People venture in new business activities i.e. demand for machines, tools, equipment and other capital goods increases. New industries come into existence and demand for labor increases which increase the employment rate or unemployment decreases.

AQA AS Economics Questions With Answers

- AQA AS Economics Unit 1 Section A

- AQA AS Economics Unit 1 Section B Part 1

- AQA AS Economics Unit 1 Section B Part 2

- AQA AS Economics Unit 2 Section A

- AQA AS Economics Unit 2 Section B part 1

- AQA AS Economics Unit 2 Section B part 2

- AQA AS Economics 2015 Unit 1 Section A

- AQA AS Economics 2015 Unit 1 Section B Part 1

- AQA AS Economics 2015 Unit 1 Section B Part 2

- AQA AS Economics 2015 GCSE solved Question Paper