Understanding cost Variability Assignment Help

Understanding cost Variability

Cost is an essential aspect of running a business. It is the expenditure that is incurred to run any business. Every resource used in production has an associated cost attached to it. Be it labor, raw material, assets, human resources, administration etc.; all bear some cost. Businesses keep a track of the costs of the companies and analyze them from time to time so as to find the best alternatives and minimize the cost.

Understanding costs need relating it to the various processes of business i.e. production, selling or holding up assets. Some costs can be directly related to the quantity of production or output or the level of selling. For example, the cost of raw material is directly attributable to the quantity of production whereas the selling cost is associated with the number of units sold.

Variability refers to the frequent variations of fluctuations in the data. It is the extent to which the data diverge from the average of the data. Thus, cost variability refers to the changes in the cost of the company. Upon the basis of the variability, the costs can be categorized into the following three:

1. Fixed Cost:

Fixed cost refers to the cost that does not change at all in the given period of time irrespective of the change in the production. The fixed cost remains constant even if the production falls to zero. Fixed Cost as defined by ICMA (U.K.), “A cost which tends to be unaffected by variations in the volume of output. Fixed Costs depend mainly on the effluxion of time and do not vary with volume or rate of output.” The fixed costs are more famously known as standby costs, period costs or capacity cost. The fixed cost remains constant only in short period of time. In the longer run, it tends to become a variable cost as changes can be made to it as per the requirement and capacity.

The fixed costs are the necessary payments to be made by the business for running it. The major aim of any fresh business is to cover its fixed costs. When it covers its fixed costs, it is said to be on a break-even point. If the business fails in achieving that it will have to shut down its business. These fixed costs are not purely for the manufacturing process. These can be other payments as well such as rent, taxes, salary etc. They have to be paid after every decided interval and cannot be foregone. These salaries can be changed over a period of time but they are not variable. They remain fixed.

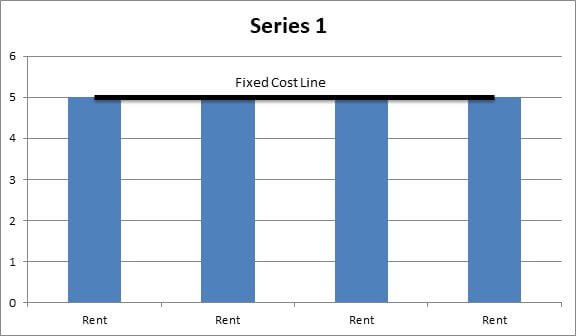

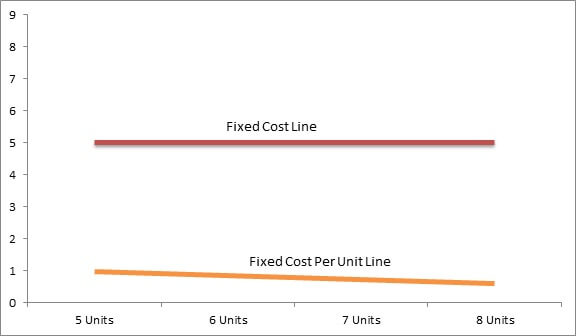

The fixed costs in total are constant but when attributed to a fixed cost per unit; it tends to fall with the increase in the number of the units produced. The fixed cost can be understood using the following example:

- A company incurs a monthly rent of $5,000 per month. This will be borne by the company even if it does on operate. In return, the company will charge this cost from its customer. If the company produces 1,000 units, $5 (5000/ 1000) will be allocated to each product i.e. fixes cost per unit. If it increases the scale of production to 2,000 units, the fixed cost per unit will fall down to $2.5 (5000/ 2000).

This can be illustrated by the following graph:

When the fixed cost will be studied with the production units, the fixed cost per unit will come out to be as follows:

The fixed costs can be further categorized into following:

Understanding cost Variability Assignment Help By Online Tutoring and Guided Sessions from AssignmentHelp.Net

- Committed Costs: Committed costs are the costs that the business or the managers are under obligation to pay or have committed to pay. These costs are important for the establishment and physical existence of the business. Such commitment costs never change for a given period of time. These cannot be readily changed. These cannot be eliminated and stays with the company. Examples for such committed costs are Depreciation, Taxes, Insurance and Rent etc. These are to be paid by the business anyhow. In case the business fails to pay such costs, the business will be facing a shut- down situation.

- Managed Costs: Managed costs are the costs that have to be incurred for running the current operation in the company for e.g. Manufacturing, transportation etc. These are generally the salaries or wages to be paid.

- Discretionary Costs: Sometimes there are certain decisions or policies that are made by the company or the managers which require funds or costs to be incurred. These are at the discretion of the managers and can be readily altered as per their convenience.

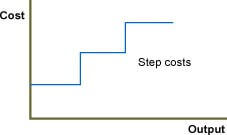

- Step- Costs: The step costs are partly variable and partly fixed. But these are different from the fixed These costs remain variable for a given amount of output and fixed for a given amount of output. These form a graph just like steps of a stair. This can be seen as follows:

2. Variable Cost:

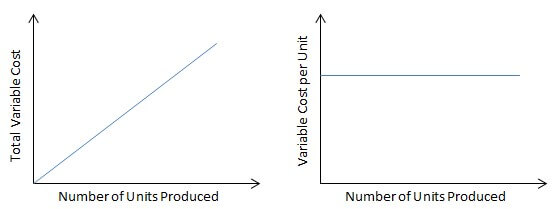

Variable Cost refers to the cost that varies in proportion to the units produced. The variable cost in totality increases with the increase in the number of units produced. This means the variable cost is directly proportional to the number of units produced. However, it is to be noted that the variable cost increases in totality with the increase in the number of units. The variable cost per unit remains the same or constant. The variable cost includes:

- Direct Material Cost,

- Direct Labor Cost, and

- Direct Expenses

All these together contribute to the variable cost. So, if the cost of producing a single unit involves employing 1 unit of raw material, 1 hour of labor and $1 as direct expenses; provided further that the cost of raw material is $5 per unit and the wages for 1 hour labor is $5, the total variable cost of the product will be $5 + $5 + $1 = $11. Thus, with every unit produced, the total variable cost will be increased by $11. This can be illustrated by the following graph:

3. Mixed Cost:

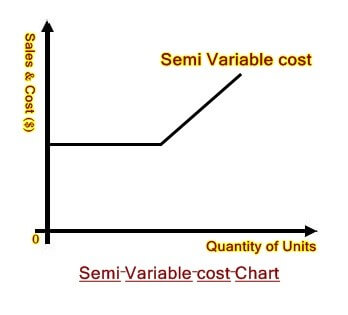

Mixed cost refers to a mix of both fixed as well as variable cost. It is a combination of the variable as well as a fixed cost which is why it is known as Semi-variable cost. As per the traits of both variable and fixed costs, they tend to increase with the increase in the production but at the same time they tend to remain constant and do not change with the change in the production. In simpler words, it tends to remain constant or fixed up to a certain level; and once it is crossed, they tend to become variable. This type of costs can be seen in the business areas where the workers are paid on the basis of the units produced by them along with a fixed pay. In case the business’s capacity increases, that also amounts to an increase in the variable cost but keeping the fixed cost constant.

This can be understood using the following example:

A company is paying its employees an amount of $1000 as fixed salary for any number of units he produces. If he exceeds the production level i.e. 100 units, he will get paid $12 for every extra unit he produces.

Now, the graph for such a salary will remain till the employee produces 100 units. Once he exceeds the 100th unit, the graph will turn into a variable one where it will increase by $12 for every unit he produces. Such a graph will be drawn:

Mathematically, the mixed cost can be represented as follows:

Mixed Cost = Total Fixed Cost + (Units * Variable Cost per unit)

How can assignmenthelp.net help you in solving Accounting Assignments?

How can assignmenthelp.net help you in solving the Marketing Assignments?

Assignmenthelp.net is one of the main Assignment Help providers in the world. We have a group of specialists who are committed to furnishing you with the quick and best administrations. These specialists have broad information in their separate fields and have a good experience and expertise in the pragmatic and corporate world. These specialists will help in solving the assignments for you and composing papers and research work. They will give 100 % authentic and plagiarism free content for your assignments. While you finish different tasks, we chip away at your assignments and help you in getting decent evaluations. All you have to do is simply upload your task with us with a due date. Request a quote from our customer care executive, pay the amount and get your work conveyed before the due date. You can get your task redid according to your prerequisite.

Not just assignments, we likewise give online tutoring classes for different subjects like mathematics, science, administration, English and so on. You can take demo classes also. Our specialists will help in clearing your doubt questions and help you in scoring decent evaluations. You can settle the calendar for the classes according to your convenience and necessity. You can ask any question from our customer care executive through live chat. We are accessible 24 *7 at your administration. We provide:

- Plagiarism free content

- 100 % Authentic Content

- 100 % Customer Satisfaction

- On time Delivery

- Privacy of the customer

- Live Chat

- 24 * 7 availability

So, what are you sitting tight for? Sign on to assignmenthelp.net now and benefit the best administrations and enhance your score on the review card.

Email Based Assignment Help in Understanding cost Variability

Following are some of the topics in Understanding Cost in which we provide help:

Help with Accounting | Management Accounting | Accounting Homework Help | Accounting Assignment Help | Cost Accounting | Online Tutoring | Financial Accounting | Email Based Accounting Homework Help