Accounting Assignment Help With Break Even Analysis

The Break Even Point is that point of sales at which the business earns no money. In other words, it the volume of sales which just allows covering the expenses i.e. Variable and Fixed Charges. In other words, it is the point where Earnings before Interest & Tax (EBIT) = 0.

| Particulars | Amount |

|---|---|

| Sales | XXX |

| Less: Variable Cost | (XXX) |

| Contribution | XXX |

| Less: Fixed Cost | (XXX) |

| EBIT | XXX |

Thus, for getting the Break-even point the Sales in the above format should be such that the EBIT becomes 0.

In other words, it can be explained as the point where the Total Revenue and Total Cost are equal. Thus, there is no profit no loss situation.

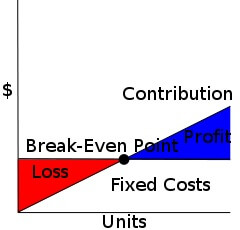

This can be shown with the following Graph:

From the Graph you can see that at the Break-even Point both the lines of Revenue and Cost meet and no profit or loss exists. Any fluctuation from this point will lead to either profit or loss.

How is the Break-even Analysis useful?

The Break-even analysis is a useful concept. It helps the businesses to determine a level of sales which must be exceeded in order to make profit. This gives the businesses a rough idea to work out on the business plan and their marketing strategy which can help them to generate enough sales so as to cover the costs and earn profits. Many of the businesses have the question about how much they should earn to cover a specific expense at least. Thus it makes it easy to determine through Break-even point as the amount of sales must be equal to the Level of Sales at Break-even point + the amount of the expense to be covered.

Identifying a Break-even point gives the businesses an insight to develop a dynamic plan and find relationships between revenue, costs, sales and Break-even point. It lays down the goals for the marketing department about how many the sales they need to make. The target plans help to achieve the business goals.

Apart from this the Break-even point helps in figuring out and testing the feasibility of the business plan. It can help the management to design a model in such a way that they can lower their variable expenses and fixed costs and make out a plan which is profitable for the business.

In many cases, if an entrepreneurial venture is seeking to get off of the ground and enter into a market it is advised that they formulate a break-even analysis to suggest to potential financial backers that the business has the potential to be viable and at what points.

The Break-even Analysis can be used in finding many other results:

1. Break-even (in sales) = (Fixed Cost)/(P/V Ratio) where, P/V Ratio = (Contribution/Sales) *100.

2. Break-even (in quantity) = (Total Fixed Cost)/(Contribution per unit)

3. Margin of Safety = Margin of safety = (current output - breakeven output) Margin of safety shows the strength of the business. It shows where the business stands how safe its functions are. It shows if the business is above the Break-even point i.e. earning profit; or below the Break-even point i.e. incurring losses.

4. Margin of safety% = (current output - breakeven output)/current output × 100 Analysis of Break-even Point: The Break-even Point will behave differently to every new change in Sales or Variable Cost. The three major determinants of the Break-even Point are: Variable Cost, Fixed Cost and Sales Volume. If any of them changes, the level of Break-even point changes. The Fixed Cost never changes i.e. it is stable; which means the Variable Cost and Sales can determine the BEP.

Let’s take an initial situation where,

Sales = $ 100,000 ($10 p.u.)

Variable Cost = $ 10000

Fixed Cost = $ 20,000

| Particulars | Amount |

|---|---|

| Sales (10,000 units) | 100,000 |

| Less: Variable Cost | (20000) |

| Contribution | 80000 |

| Less: Fixed Cost | (20000) |

| EBIT | 60000 |

From above data,

P/V Ratio = (Contribution/Sales) *100

= (80000/100000)*100

= 80%

Contribution per unit = Contribution/Total units

= 80,000/10,000

= $8 p.u.

Break-even Point (in quantity) = (Total Fixed Cost)/(Contribution per unit)

= 20,000/8

= 2,500 units

Break-even point (in sales) = (Fixed Cost)/(P/V Ratio)

= 20,000/(80%)

= $ 25,000

These amounts will change if we will change the Contribution per unit and number of units.

Limitations of Break-even Analysis:

Break-even Analysis is a simple and easy concept to manage organizations but it is very rarely used because of its following limitations:

- It takes into consideration the cost side only. It does not study the sale variable on the products. This is a shortcoming as the cost does not influence the working of the business all alone.

- This system assumes that the fixed costs remain constant which is not entirely true in the short run. All the costs tend to fluctuate in the short run.

- It assumes whatever is produced gets sold which is not true in practical life.

- It assumes that the cost of production of every unit is the same which might not hold true.

Thus break-even analysis is an important concept to be taken care of in the running of a business.

Therefore, a business’s functioning is highly reliable on the proper formation of policies. The applicability of Break-even analysis is important from the point of view of business. This needs to be implemented very carefully and with deep analysis. This can get complicated at times but we are here to help you at assignmenthelp.net where you can contact us at any time and we will help you with your queries and helping you out with your assignments. We respect that you can’t lose on marks and that is why we are here to provide you with the best facilities and qualitative results. You can also take online classes from the best tutors. We believe in providing the best services for your satisfaction. We serve our clients with good and satisfying work and with complete dedication.

For more information regarding the Accounting and Financial Assignment please visit assignmenthelp.net where you can have a look at some of our assignments and see how effective they are.

Email Based Homework Help in Break Even Analysis

Following are some of the topics in Marginal Costing in which we provide help:

Accounting Assignment Help | Accounting Homework Help | Help with Accounting | Management Accounting | Cost Accounting | Online Tutoring | Financial Accounting | Email Based Accounting Homework Help