Strategic Case Analysis A Case Assignment of Tesla

Introduction

The purpose of the report is to prepare a case study portraying the issues faced by Tesla and the strategies to be adopted in order to overcome the identified issues. The report will accentuate on identification of the pertinent issues, which the management of Tesla requires addressing. Besides this, the report will cater a detailed illustration of the wide range of analytical tools used by Tesla in order to diagnose the identified issue. The report will portray the use of PESTLE analysis, and Porters Five Forces analysis for effective evaluation of the external business environment Tesla deals with. Apart from this, the report will conduct analysis of the internal business environment as well with the utilization of Resource Based View (RBV), VRIO analysis, and Value Chain analysis. Further, the report will accentuate on analyzing the present corporate-level as well as business-level strategies of Tesla. Besides this, the report will describe the manner, in which the strategies must be executed, analyze the performance. Lastly, the report will decide if the organizational capabilities and resources align with the current demands in the external business environment, and if the articulated strategy will result in forging a competitive advantage for the business.

Findings

Company Background

Tesla is one of the leading multinational companies operating in the automotive and energy storage industry. As of 2018, Tesla reported revenue of US$21.461 billion and the overall production output was 245,162. At the same time, the operating income of the organization was US$-0.388 billion and the net income registered by the organization was US$−0.976 billion at the end of 2018. Besides this, the total assets of the firm in the year 2018 were US$29.740 billion and the total equity was US$4.923 billions by the end 2018. The organization has an employee strength of 45, 000 as of 2018 (Tesla Inc, 2018).

The mission of Tesla is to accelerate the world’s evolution to sustainable energy. The organization desires to bring about evolution as well as fast-track the unsoiled transport energy creation movement with the aim of manufacturing its products and services more attainable alongside affordable for the consumers (Tesla Inc, 2018). The company hopes to harness as well as merge the full potential of their batteries, storage devices, and renewable energy production along with the electric cars in order to forge a completely energy sustainable ecosystem.

Issue Identification

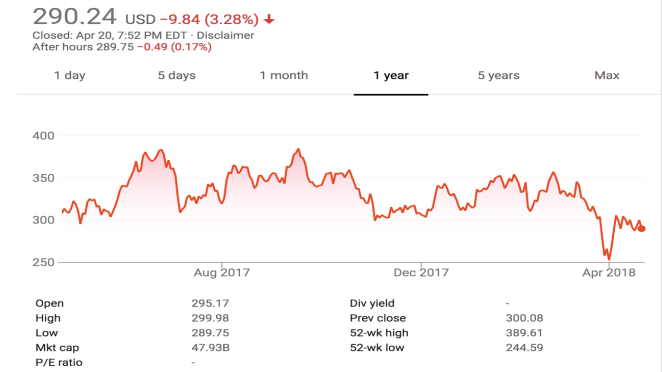

In September 2018, the stock price of Tesla reached to the hit the highest point for the first time ever with $389.61 apiece share (Nasdaq, 2018). Nevertheless, due to the delays in the manufacturing of model 3 along with a deadly crash of the autopilot, the share value of the firm has currently went on a downhill trend as witnessed in the chart below. The chief issues that are affecting the forthcoming success of the company mainly entail their automotive products. As per the annual report of Tesla 2018, the organization has effectively figured out the risk aspects in the cash flow, manufacturing, consumer adaption, as well as the governmental and legal regulations (Tesla Inc, 2018).

Figure 1: Stock Prices

(Source: Nasdaq, 2018)

Value Creation

The business model of Tesla has a wide range of constituents, which intends to create value for the clients. It is the sole firm in the world catering products for production, storage, as well as consumption. As per the annual report, the firm comprises of a string brand image and offers advanced and innovative technology facets like over the air updates in software, autopilot, along with enriched safety features. The company also provides their consumers with an extensive range battery life, which surpasses the rival companies (Tesla, 2019).

Discussion

External Analysis

For analyzing the external business environment, the PEST framework would be applied for effective identification of the threats. Besides this, the external analysis will also portray the application of porter’s five forces in order to gain in-depth understanding of the competition level in the market. The PEST framework is as follows.

PEST Framework:

|

Political and Legal |

Government Regulations · The international and domestic regulations, political climates, tax reforms, as well as the labor laws can affect the growth of the business · The potential mitigation of the clean energy cost-effective incentives has the ability to affect the sales alongside increase the costs for the business · Tesla requires adhering to the safety and environmental regulations and laws, which imposes significant costs Legal · Potential claims of liability · Probable claims of warranty · Potential recalls of the products · Possible claims of intellectual properly infringements · Potential for the battery cells made of lithium ion to catch fire |

|

Economic |

· Weak manufacturing performance as well as operating at a significant loss causing analyst, investor, and consumer caution. · Possible difficulties in effective achievement of the targeted manufacturing expenses · Requirement of considerable funds in order to invest for effective expansion of the business in delivery centers, stores, service centers, supercharger stations, factories, as well as ramping up the manufacturing processes · Tesla is subjected to the fluctuations in the monetary rates of exchange · $10.17 billion in cumulative principal debt at December 31, 2017 |

|

Social |

· Relies upon the rapid adaption to the massive marketplace of the electric vehicles for effective growth of the business in upcoming days · Determinants, which are affecting the perception of consumers regarding the vehicles of Tesla including features, driving performance, safety, cost, defects, range of battery, access to the charging devices, economic incentives, the cost of the fuel, and other electricity driven vehicles in the marketplace (Karamitsios, 2013) |

|

Technological |

· Reliance on the single source suppliers for the effective delivery of elements · The requirement of employing as well as retaining the technically experienced workers for effective expansion of the organization’s car manufacturing plants along with its battery production factories · Delays in manufacturing the incline of existing as well as new products · Unrealized timeliness of manufacturing caused due to the technological issues at the manufacturing plants |

Table 1: PEST framework

(Source: created by the learner)

Porters Five Forces:

The application of porter’s five forces plays a vital role in thorough comprehension of the competitiveness of the business environment.

Rivalry amid the existing players (High):

Tesla faces high level of competition in the marketplace, as the competitors of Tesla such as BMW, Mercedes, Porsche, and Audi has a highly strong brand image in the marketplace. Thus, it is of importance for the Tesla to lay high emphasis on innovation in their vehicles for effectively competing with the rival companies and increase their sales and profit margins extensively (Tesla Inc. Five Forces Analysis (Porter’s Model) & Recommendations - Panmore Institute, 2016).

Power of purchasers (moderate):

The power of buyers in context of this case is moderate. It is because there are very few companies operating in the automotive industry that offers luxury vehicles at the price which Tesla does. Therefore, it could be stated that the power of consumers in scaling of the price is moderate, as customers are always the main component of any business (Dudovskiy, 2018).

Supplier Power (High):

The power of suppliers in context of this scenario is quite high, as the number of suppliers for the companies, dealing with luxury vehicles is considerably low. The suppliers have the potential to drive up the prices of the resources and raw materials for the business of Tesla.

Threat of being substitute (High):

The substitution threat is considerably high in case of Tesla. It is because the consumers in the marketplace have the option to shift from one company to another company, if the other organization is providing luxury vehicles at a cheaper rate as compared to that of Tesla. Therefore, it is essential for Tesla to carry on with the innovation in their models and keep the price as low as possible to mitigate the risk of substitution (Tesla Inc. Five Forces Analysis (Porter’s Model) & Recommendations - Panmore Institute, 2016).

Threat of new entrant (Low):

The threat of new entrant in the market is quite low in this specific context. It is because it is highly difficult for a company to enter the market of luxury vehicles and compete with the companies that have already forged a strong and positive brand image among the consumers in the marketplace (Dudovskiy, 2018).

Opportunities of Tesla

- Effective expansion to the other regions of the world such as in Asian subcontinents

- Formulation of completely independent driving abilities

- Expansion of the products and services in the new marketplaces such as trucking as well as public transportations (Pratap, 2017)

- Integration of sustainable technologies in the upcoming days

Internal Analysis:

The core competencies of the company are as follows.

- Vehicle Engineering

- Extensive energy storage

- Power train engineering

- Innovative production

- Break down test simulation

- Computer assisted design

The capabilities of the organization are as follows.

- Self-driven capabilities

- Longevity of the battery life in travelling

- Vehicle control as well as infotainment software application

- Dual glide power train, which permits for the instantaneous response of the motor, traction control, as well as controlled performance

VRIO of Tesla

|

Resources |

Value |

Rare |

Imitation |

Organization |

Competitive Advantage |

|

Scopes in e-commerce using the existing IT capabilities |

Yes, it is of importance for Tesla to leverage the opportunities since the e-commerce space is growing at an exponential rate |

No, majority of the rival companies are making investments in IT in order to enter the vacancy (TESLA, INC., 2018) |

The in-house analytics and AI could be quite difficult to imitate |

It is the initiation of the organization |

For the long run it can cater sustainable competitive advantage |

|

Pricing Strategies |

Yes |

No |

Pricing strategies of the firms are imitated in the sector on a regular basis |

Yes, the organization comprises of the engine of pricing analytics |

Temporary |

|

Flexibility of the supply chain networking |

Yes |

Yes |

The rival firms also consists of adaptive supply chain networks |

Utilized completely |

Neutral, as it assists in keeping the business on track |

|

Position within the wholesalers and retailers |

Yes, the company has a positive relationship with the wholesalers and retailers (TESLA, INC., 2018) |

Yes, the firm has dedicated channels in association |

Difficult but not impossible |

Yes, the firm has successfully used it over the last years |

Sustainable competitive advantage |

|

Consumer Community |

Yes, the customers of Tesla are involved in co-creation of the products |

Yes, the company has been successful in forging healthy and strong relationship with the clients |

It is quite tough to imitate such a relationship with the community and consumers |

There are still upsides left |

Strong competitive advantage |

|

Access to the cheap resources and capital |

Yes |

No |

It is imitable by the other firms |

Still not been completely taken advantage of |

Not important in acquiring competitive advantage |

|

Access to the critical resources for effective execution |

Yes |

Yes, it is because the rival companies require coming to the terms of the Tesla’s dominant position in the marketplace (TESLA, INC., 2018) |

It is imitable by the competitors |

Yes |

Caters sustainable competitive advantage |

Table 2: VRIO framework of Tesla

(Source: created by the learner)

Value Chain Analysis of Tesla

The value chain analysis of Tesla is an analytical framework, which supports in effective identification of the business operations, which have the potential of creating value and competitive advantage for the electric automotive manufacturers.

The inbound logistics of the firm entails the storage and receipt of raw ingredients for building up the electric vehicles, solar panels, and systems for energy storage. Besides the raw ingredients set, the firm make effective utilization of the scarce materials like steel, aluminum, cobalt, copper, nickel, and lithium. At present, the extremely sophisticated practices of inbound logistics are not the key source of creating value for the firm. Tesla mainly operates on the develop to order basis that means the bottlenecks in patches supply turns out to be a issue. It is necessary for Tesla to develop strategic long-term relationships with the suppliers (Dudovskiy, 2018).

Tesla carries out the assembly and manufacturing operations at its facilities. The operations of Tesla are categorized into two sections, one of them is automotive, and the other one is energy production and storage. The automotive section deals with the design, establishment, manufacturing, and selling of the vehicles. The section of energy production and storage deals with designing, manufacturing, and installing, and lease of the immobile products of energy storage as well as systems of solar energy. Besides this, the outbound logistics of Tesla entails warehousing alongside dispersion of the energy containers system, electric vehicles, and solar panels (Dudovskiy, 2018). The marketing and sales practices of Tesla are not conventional. The company completely relies on the word of mouth promotion. The potential to garner the attention of widespread media coverage at the international scale serves as the major value source in regards to the increasing level of brand recognition.

Current Business Level and Corporate Level Strategies

Positioning:

Tesla places its vehicles in the regions of Asia, North America, and Europe and the density comprises of both rural and urban areas. The age group considered is 25 to 60 for both males and females. The firm prefers positioning their vehicles among hard core loyal, soft core loyal and switchers as well. The status of the users is non-users, first-time users, and potential users. Lastly, the social status entails the middle and upper className people.

Growth Strategies: Market Penetration (Primary) and Product Development (Secondary)

Tesla makes use of market penetration as the primary strategy because It enables extensive growth of the business by increasing the sales and revenue figure in its existing marketplaces. On the other hand, Tesla makes effective utilization of the product development as its secondary strategy. With effective implementation of this strategy, the firm seeks to grow through the development of new vehicles, which helps in generating more sales. Tesla makes use of effective and modern technologies for minimum ecological impact (Tesla, Inc.’s Generic Strategy & Intensive Growth Strategies (Analysis) - Panmore Institute, 2016).

Financial and Market Based Measures

|

Ratio Analysis |

Formulae |

2016 |

2017 |

2018 |

|

“Return on Assets %” |

“= net income / average total assets” |

-4.39 |

-7.64 |

-3.34 |

|

“Return on Equity %” |

“= net income / shareholders' equity” |

-23.11 |

-43.63 |

-21.31 |

|

“Return on Invested Capital %” |

“= (operating income (1-tax rate)) / book value of capital invested” |

-6.27 |

-11.47 |

-1.9 |

|

“Gross Margin %” |

“= Gross profit / Revenue” |

22.85 |

18.9 |

18.83 |

Table 1: Tabular Representation of ratio analysis of Tesla

(Source: Created by the learner)

The table that is provided above gives a clear picture of the “ratio analysis” of the “statement of financial position”. This enables the business entities in solving any kind of issues that may rise in the business. There are different ratios that are being used by the business entity Tesla to get proper information regarding the stability of the finance of the business. The analysis of the different kinds of ratios will be explained below:

“Return on Assets”

This helps the business enterprises to check for the return that is received from the investment of the total assets. It can be checked that there is a data of last three years. It is seen that the “return on asset” is -4.39 in 2016, -7.36 in 2017 and -3.34 in 2018. This suggests that the percentage is negative and as well as very much fluctuating. This is a serious condition of the business.

“Return on Equity”

This helps the business enterprises to check for the return that is received from the equity of the business. It can be checked that there is a data of the last three years. It is observed that the “return on equity” for the last three years is -23.13, -43.63 and -21.31 respectively. It can be observed there is a very high negativity in the “return on equity”. The percentage is also fluctuating in nature, which is going to harm the environment of the business if the work is not done properly.

“Return on Invested Capital”

This is another important aspect of the business to check the “return in invested capital”. This is checked through which there is presentation of data for the past three years. It can be observed from the above table is that “return on capital investment” for the last three years is -6.27, -11.47 and -1.9 respectively. This gives a clear view of the fact that there is a very high fluctuation among the business or the enterprise.

“Gross Profit Margin”

This is another aspect of the business to check the “margin of gross profit”. This shows the “amount of gross profit” that is earned by the business enterprise from the “revenue”. It can be observed that the “gross profit margin” is 22.85 in 2016, 8.9 in 2017 and 18.83 in 2018. This suggests that there is high fluctuation in the “gross profit margin”. This is necessary for the business enterprise to understand and work according to a certain structure to restrict the business entity Tesla from having so much fluctuation in the business in regards to the “gross profit margin”.

Benchmarking

This significant aspect indicates the business entities to find out the different aspects of the business that are performing well for the business. It can be witnessed from the “ratio analysis” that the best performing areas for the business enterprise Tesla are “current assets” that forms the “current ratio” of the business, the “gross profit” that forms the “gross profit margin” and the “revenue” that has also increased. These significant areas are being performing well for the business enterprise in order to fight against any kind of “issues of finance”.

Conclusion

On completion, it can be concluded that the major issue faced by the company was collapse in market share due to the delays in manufacturing of automotive vehicles. Besides this, the other aspects of risks entail manufacturing, cash flow, consumer adaption, along with the legal as well as governmental regulations. For Tesla, it is essential to consider the threats existing in the external business environment and make effective utilization of its core competencies, resources, and capabilities in order to deal and overcome the existing challenges for acquiring a strong competitive position. Besides this, the company carries out value chain analysis and VRIO analysis to determine the resources and capabilities that contribute towards the sustainable competitive advantage of the business.

Recommendations

As per the strategic analysis conducted, the key strategy suggestion, which Tesla requires accentuating is to enhance its efficiency in manufacturing. It is of importance for the firm to expand their business into the overseas market alongside adding up to the public transport vehicles to the product lines extensively. However, it is essential for the form to make sure that their current manufacturing plants and systems are capable of maintaining efficiency or else the expansions will turn out to be ineffective. Besides this, Tesla requires working on the extensive diversification of the supply chain because the existing suppliers are of single source and thus, forging a stronger supplier potential and power for the forthcoming delays. As last, considering the existing rates of expenses that are quite high, it is of utmost significance for Tesla to figure out ways in order to curtain the costs or else expand their investing and financing operations.

Implementation

Tesla requires employing more skilled candidates at present in order to carry on with the devised manufacturing growth as well as introduce the innovative semi-electric vehicles. Tesla must focus on curtailing the operational costs for effective continuation of the business growth. It is essential for the company to initiate with raising funds through issuing latest common stocks and then utilize the other equity financing forms during the plans for making investments. Besides this, the firm must look forward to fuse SpaceX or Uber and Tesla for avoiding the risk of bankruptcy. It is essential for Tesla to figure out and comprehend the reasons that caused such a situation, plan for the potential issues, sense the point of trigger, and respond. It is of importance for Tesla to alter their existing practices in order to effectively accelerate the global transition for sustainable energy.

References

Dana, C. (2018). A Strategic Audit of Tesla, Inc.: Electrifying our Future or About to Run out of Energy?.

Dudovskiy, J. (2018). Tesla Porter’s Five Forces Analysis - Research-Methodology. Research-Methodology. Retrieved 3 May 2019, from https://research-methodology.net/tesla-porters-five-forces-analysis-2/

Dudovskiy, J. (2018). Tesla Segmentation, Targeting and Positioning: overview - Research-Methodology. Research-Methodology. Retrieved 3 May 2019, from https://research-methodology.net/tesla-segmentation-targeting-and-positioning-overview/

Easton, M., & Sommers, Z. (2018). Financial Statement Analysis & Valuation, 5e.

Edwards, A., Schwab, C., & Shevlin, T. (2015). Financial constraints and cash tax savings. The Accounting Review, 91(3), 859-881.

Karamitsios, A. (2013). Open innovation in EVs: A case study of Tesla Motors.

Liket, K. C., & Maas, K. (2015). Nonprofit organizational effectiveness: Analysis of best practices. Nonprofit and Voluntary Sector Quarterly, 44(2), 268-296.

Nasdaq. (2019). Tesla, Inc. Common Stock Historical Stock Prices. Retrieved from https://www.nasdaq.com/symbol/tsla/historical

Pratap, A. (2017). TESLA SWOT ANALYSIS. notesmatic. Retrieved 3 May 2019, from https://notesmatic.com/2017/10/tesla-swot-analysis/

Robinson, T. R., Henry, E., Pirie, W. L., & Broihahn, M. A. (2015). International financial statement analysis. John Wiley & Sons.

Tesla Inc. (2018). Retrieved from http://www.annualreports.com/HostedData/AnnualReports/PDF/NASDAQ_TSLA_2017.pdf

Tesla Inc. Five Forces Analysis (Porter’s Model) & Recommendations - Panmore Institute. (2016). Panmore Institute. Retrieved 3 May 2019, from http://panmore.com/tesla-motors-inc-five-forces-analysis-recommendations-porters-model

TESLA, INC. (2018). Retrieved from http://www.annualreports.com/HostedData/AnnualReports/PDF/NASDAQ_TSLA_2017.pdf

Tesla, Inc.’s Generic Strategy & Intensive Growth Strategies (Analysis) - Panmore Institute. (2016). Panmore Institute. Retrieved 3 May 2019, from http://panmore.com/tesla-motors-inc-generic-strategy-intensive-growth-strategies-analysis

Tesla. (2019). Supercharger | Tesla. Retrieved from https://www.tesla.com/supercharger