Research on Financial market and Capital Budgeting Analysis Sample Assignment

Introduction:

The facts associated with the financial market of Australia can be understood with the help of this report. The report has taken the help of various financial institutions to display the varying perspectives of budding investors that are willing to make investments in other institutions. Investors play a vital role in heightening the institution's funds. The report will help to understand the three questions associated with financial management, and these questions help to understand the financial clauses that the institutions can utilize for enhancing their activities. The companies' working capabilities are enhanced by the increase of funds, and thus the institution's objectives can be acquired. The report also aids in understanding the regulations of the financial market of Australia that are generally imposed upon the Australian enlisted companies. The report will help to understand the processes and problems that are needed for enlisting in ASX. The Australian "financial advisory service registration" can also be understood with this report, and this further helps to understand the data needed in registrar (HARVEY, ALDRIDGE and COHN-URBACH, 2015). The report has finally assessed the threats and analyzed the project by taking the help of a case study. The complete data related to the institution's financial capabilities and the procedures for enlisting in the "Australian Stock Exchange" are provided in the report.

The enlisted companies can be identified with the aid of ASX, and this displays the companies' operations. The company's overall data are provided on the official website of ASX, and this aids in understanding the business capabilities of the company. Risk is an important feature in every business, and the company's capability to develop its operations can be defined by these risks. When the company gets updated in ASX, it helps them in seeking new investors so that the organization's activities can be expanded. The report contains the assessment of the four companies enlisted in ASX, and hence all the companies display their worth in doing their activities.

Part 1: Research conducted on the financial market of Australia

1.1. Comparing the four vital Financial Institutions

|

Particulars |

Commercial Banks |

Insurance Companies |

Investment Banks |

Investment Funds |

|

Classification |

Banks that operate for those individuals that desire to invest money based on the regulations set down by the central bank are termed as commercial banks (TURNER and NUGENT, 2015). These banks prefer short-duration credit so that the market securities can be easily accessed |

Insurance companies are those companies which help individuals to retrieve their damages and losses. These companies operate only when individuals need them (Aph.gov.au., 2020). For instance: accident, disability, death, damage and other issues |

Investment banks deny deportations and are known to help government, business houses and individuals to collect money (Rba.gov.au. 2020). These investment companies are termed investment funds from individuals or investors. |

The capital supply that is generated from investors and applied in various funds like Hedge funds, mutual funds and revenue market funds are termed as investment funds, and this help to enhance the business operations. |

|

Operational Market Sector |

The operations of these banks are included within the banking sector, and individuals can save their income in it (Financialservices.royalcommission.gov.au. 2020) |

These companies come under the insurance sector and prove helpful for the individuals as they can invest their salary (Financial services.royalcommission.gov.au., 2020) |

This banking belongs to the sector of investment banking and provides investment opportunities to investors and individuals |

These also belong to the sector of investment banking and defines the various funds which help individuals to make investments (Rba.gov.au. 2020). |

|

Important business operations |

The important business operation of these banks is providing advances and loans, bill discounting, overdraft facilities and several other activities. They help people save money in banks (Pwc.com.au. 2020) |

The vital operation of these companies is investment and underwriting. |

The main activity of these investment banks are: handling mergers, act as a financial adviser, acquisitions, and underwriting new stock matters |

The main activity of these funds is developing the investment’s habit among people |

|

The vital income sources |

These banks generate income through interests that they earn from advances and loans and from handling government works (Nyasha and Odhiambo, 2020) |

These companies generate income through investments and through underwriting income (Hannover-re.com., 2020) |

These banks generate income through fees that they procure from financing, advising, gathering clients and different services (Rba.gov.au. 2020). The dividends that they procure from investment also become their income source |

These funds generate income through further investments by larger companies and the fees that they collect from them like account fee, purchase fee, sales fee and several other investment charges |

This can be explained through an example:

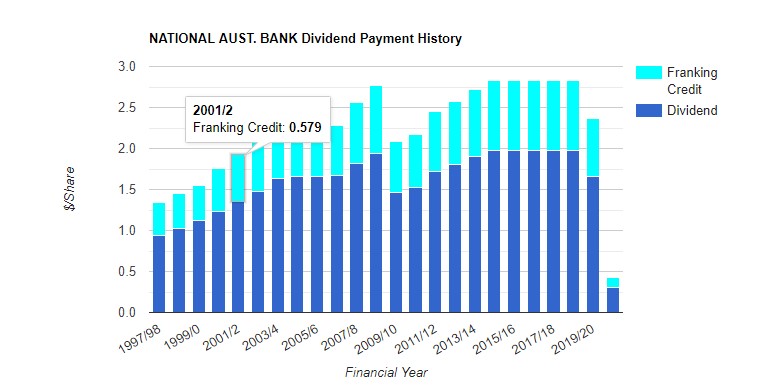

“National Australian Bank”: Commercial Bank

- NAB is the enlisted code of this bank

- The bank got enlisted on ASX in the year 1988, 14th October

- The bank’s present market cap is 29.01B

Source: (Capital.nab.com.au. 2020)

- The current, complete share outstanding is calculated as 2.88 B

- The company's CEO is Ross McEwan, and the company's chairman is Philip Chroncian (nab.com.au., 2020)

- The company’s dividend graph is given below:

- 07.2020

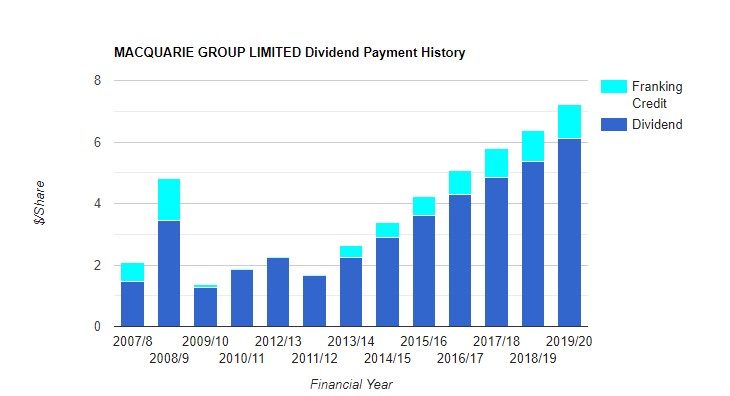

“Macquaire Group”: Investment Bank

- MQS: ASE is the enlisted bank code

- The bank got enlisted on ASX on 30th of October,1990

- 49B is the company’s market cap

- The present net unresolved share is calculated at 338.55

- The company’s CEO is Shemarawikramanayake, and the company's chairman is Peter Warne (com. 2020)

- The company’s dividend graph is given below:

- 18.12.2019

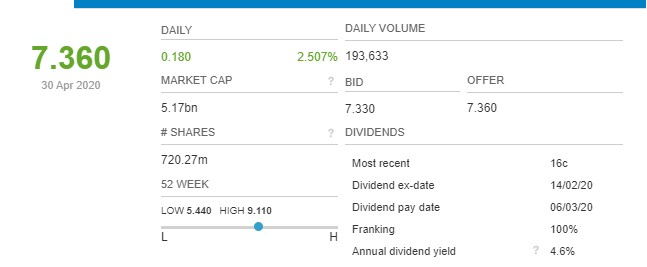

“Agro Investments Limited”: Investment Funds

- ARG is the code of the company

- The company got enlisted under ASX in the year 2015, 3rd July

- The company’s net unresolved share is unavailable

- The company CEO is Jason Beddow, and the chairman is Russel Allan Higgins

- The company’s dividend graph is provided underneath (org., 2020)

- 06.03.2020

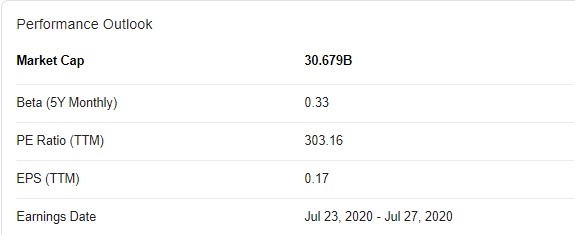

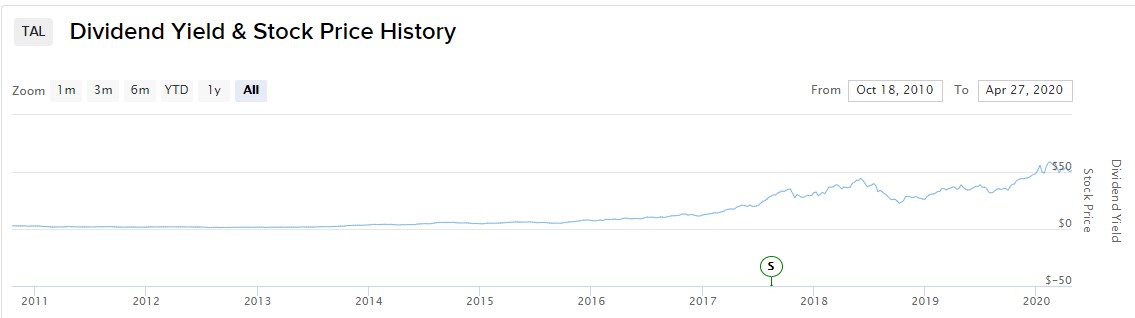

“TAL Life Limited”: Insurance Company

- TAL is the enlisted bank code

- In 1996 the company got enlisted in ASX

- The company's present market cap is 30.679B.

- The present net unresolved share of the company is 384. 34 M

- The company CEO is Brett Clark, and the chairman is Duncan Boyle (Dai-ichi-life-hd.com., 2020)

- The company’s dividend graph is given below:

- 04.2020

1.2 Assessing the three queries of Financial Management:

- Capital budgeting: The procedure which helps the company to understand and decide which permanent assets can prove beneficial for them is called capital budgeting. This process also helps to understand the company’s potential expenditures and investments (JOHNSON, PFEIFFER and SCHNEIDER, 2017). This can be determined with the help of the company's long-duration investments so that the company can have a satisfying future.

Capital budgeting is important because:

- Long duration goals can be attained with the help of the capital budget. These goals play an important role in the company's business as even a small decision error can impact the business in the long term. Hence, decisions should be taken after an apt assessment.

- A vast amount of fund is needed for capital investment since the company is investing in its profitable future. The expenditures can be identified with the help of the capital budget, and it even controls the expenditure according to the project necessities (TURNER, 2016).

- It helps to assess the risks that can occur in long-duration investments and thereby seeks and provides apt solutions for mitigating those risks.

The company taken into consideration to understand capital budgeting is BHP (“Broken Hill Property Company Limited”). This is a prominent resource company dealing in the extraction of gas, oil and minerals and boasts of 72000 employees. As per the latest data of July 2019, a plan related to climatic investment has been announced by the company, and the estimates have been given as $400 million. This project is associated with a decrease in greenhouse gas by taking aid of leading technologies and quality solutions (Brokenhill.nsw.gov.au., 2020). The company has even stated the predicted outcome: there will be an expected 20% curtailment in the cost of energy.

- Capital Structure: Capital structure states the liabilities and debts of the company so that the company can conduct a further assessment for future investment processes. The company has to evaluate its capital framework prior to the planning of new investment. The company's capital structure help to increase their “market share price” so that the company’s “earning per share” is heightened (AHSAN, WANG and MUHAMMAD, 2016). This capital framework helps in developing opportunities for newer investment that will help the company to enhance its business.

BHP’s latest investment displays a strong capital structure, and it is operating for a long duration, thus competing with other companies. This has become possible as the company's capital structure is powerful. It should decrease its expenditure so that it can form a profitable situation (Brokenhill.nsw.gov.au., 2020). The assessment has, however, shown that the company is operating perfectly and investing in new projects so that the company's working capability is enhanced.

- Operating Capital Management: The operating capital management helps in defining the company’s strategy so that its current liabilities and assets can be properly managed. The company's revenue is managed for easy investment procedures, and their accounting strategy can be formed which plays a vital role in the company's future investments (JAMIL, AL ANI and AL SHUBIRI, 2015). The company that boasts of efficient operating capital will enhance its earnings and improve the company's financial obligations.

BHP has freshly invested in greenhouse gas which displays that the company's operating capital is managed in a proper manner. The company's efficacy associated with the liquidation of company debts is displayed through the operating capital. This requires large investments and can affect the company's operating capital, but the company made those investments after assessing the long duration objectives (Brokenhill.nsw.gov.au., 2020). The short duration difficulties are overlooked in this case.

Part 2: Searching the facts of the market regulations of Australia

2.1. Finding facts of enlisting on ASX

“Macquire Group” is the company that has been taken into consideration

- Benefits of being an enlisted company on ASX:

- The company has the benefit to access regular growth of capital

- It has the benefit of procuring revenue for its external growth

- A platform for shares is formed

- The company can serve with greater efficacy

- It has the benefit of investing in institutions

- The company’s worth is enhanced (com.au., 2020)

- As there is an enhancement in the profile of the investors, it aids in social appearances.

- The issues company confronts after being enlisted in ASX:

- The company has to face market risks hence selling the ETPs becomes problematic in specific situations

- Calculating the tax processes of the company becomes difficult

- It becomes tough to track ETP performance

- Overseas investments become very difficult due to fluctuating exchange rates and several differing issues (com.au., 2020).

- The necessities for enlisting in ASX :

- The company should have at least 20% free float

- The holdings amount should be at least $2000 each

- There should be a minimum of 300 registered shareholders (com.au., 2020).

- The procedure for enlisting in ASX:

- The primary necessity in this process is appointing efficient advisory for a successful IPO

- The elementary activities should be performed properly, and the prospectus should possess every bit of data related to the company (STEEN, MCGRATH and WONG, 2016). The ASX members can browse the prospectus to gain information associated with the company

- The “Security Investment Commission” of Australia after viewing the prospectus can restrict IPO advertisement

- The period of exposure initiates seven days after lodging date, and the public can avail the prospectus in this period. The offer is available until the exploration period. The ASIC is capable of stopping this offer.

- After this period of exposure, the ASX processes the enlisted application

- A period of 3-5 weeks is given to retail investors for offering shrew

- Finally, the offer is sealed, and trading begins (com.au., 2020).

- The charges for enlisting in ASX are done depending on the annual fees and securities. This is then prorated as “first fiscal year”.

2.2. Finding the requirement facts for registering in the financial advisory:

A person is termed as a financial advisor if:

- The person should possess "AFS License" and should be "authorized representative."

- The person can be a director or employee of a similar corporate body having an AFS license.

- He can be a director or employee of an AFS licensee.

- A person having the authority to provide its retail clients with some personal advises concerning their products.

- The book in which financial advisers are provided with information is named as the "financial advisers register". The body which provides licenses for the appointment of financial advisers is the “Australian financial services” (gov., 2020).

- The persons appointed as financial advisers are enlisted along with their license number in the registrar, and no other person is enlisted in it. Since it is accepted that this register is managed by ASIC, the updates and added information related to authorized financial advisors is managed by "financial service license" of Australia. The updates related to AFS license must be completed in 30 days, or there may face penalty due to the breach.

- The register contains the data about the chosen financial advisor along with their individual license number (gov., 2020). The register is updated regularly by the AFS and contains the advisor’s license number which assures regular updates, but these updates should happen within 30 days.

- Minimum one product is given to the advisor while being appointed by the AFS licenses. Clients can be a wholesaler, retailer or both. Some exceptions to these products are:

- The facilities related to no cash payments and primary baking products like primary deposit goods (gov., 2020).

- The products of general insurance are an exception.

- Another exception is the client’s credit insurance; or

- All these products when combined in unison.

- Some professional degrees needed to become a financial advisor are:

- Doctorate Degree (AQF 10)

- Master’s Degree (AQF 9)

- Bachelor of Honors Degree (AQF 8)

- Graduate Diploma (AQF 8)

- Graduate Certificate (AQF 8)

- Bachelor Degree (AQF 7)

- Advanced Diploma (AQF 6)

- Diploma (AQF 5)

- Certificate (AQF 1-4)

- Bridging Assignment – Ethics

- Bridging Assignment – Legal and Regulation Obligations

- Bridging Assignment – Behavioral Finance

- Professional Designation

- Other

"FASEA" is the standard that is applicable to these advisors but the government has changed it, and the advisors are thereby provided relief for three of their licensing tenures.

Part 3. Evaluating the project and analyzing the threats:

3.1. Conducting sensitivity evaluation with the given data:

|

Investments | |||||

|

Equipment's |

2000000 | ||||

|

Working capital |

600000 | ||||

|

Total |

2600000 | ||||

|

General case study | |||||

|

Year |

0 |

1 |

2 |

3 |

4 |

|

Sale units |

350000 |

350000 |

350000 |

350000 | |

|

Sales Price |

22 |

22 |

22 |

22 | |

|

less: per unit variable cost |

11 |

11 |

11 |

11 | |

|

Per unit contribution |

11 |

11 |

11 |

11 | |

|

Total contribution |

3850000 |

3850000 |

3850000 |

3850000 | |

|

Fixed cost |

-350000 |

-350000 |

-350000 |

-350000 | |

|

Depreciation |

-450000 |

-450000 |

-450000 |

-450000 | |

|

Net Profit prior to paying of tax |

3050000 |

3050000 |

3050000 |

3050000 | |

|

Tax @30% |

-915000 |

-915000 |

-915000 |

-915000 | |

|

Profit after paying of Tax |

2135000 |

2135000 |

2135000 |

2135000 | |

|

Add: Depreciation |

450000 |

450000 |

450000 |

450000 | |

|

Add: Operating capital |

600000 | ||||

|

Residual Value |

200000 | ||||

|

Free revenue Flow |

-2600000 |

2585000 |

2585000 |

2585000 |

3385000 |

|

Discounting rate @ 10% |

1 |

0.909091 |

0.826446 |

0.751315 |

0.683013 |

|

Discounted Cash Flows |

-2600000 |

2350000 |

2136364 |

1942149 |

2312001 |

|

Total Present Value |

-2600000 |

2136364 |

1765590 |

1459165 |

1579127 |

|

NPV |

4340246 | ||||

As regards the provided case scenario, one can conclude that the concerned company has the capability of selling 350000 units at $22 price, and the variable cost expended per unit will be $11. The project's NPV will then be $ 4340246. But if there is a decrease in the sales unit by 10%, it will impact the NPV and lower it to $ 365559. Again, if the product's sales price is lowered by 10% and the net units sold remains the same as the present case scenario, the NPV will definitely decrease. But the impact remains the same as in the case of decreasing sales. When variable cost is increased, functional cost increases and the free revenue flow decreases. Thus the sales can decrease by $ 6255597. Again, if there occurs 10%increase in fixed cost, the NPV can change to $ 6878005.

Conclusion:

Through this report, one can gain knowledge about some Australian enlisted companies that are performing great business. But understanding the manner in which they got enlisted in ASX is also important, and this report has stated the various commercial institutions along with numerous instances that help in comparing these companies based on market assessment. The company dividends display their future business worth, and these financial institutions prove beneficial for the country's economy because the customers form the habit of investing their personal income expecting better returns. The latter half of this report has even stated that the financial advisor's task is not easy, and the selection should be made based on proper licensing and qualification. Professional standards are stated, and this has helped to understand the operations of financial advisors, various products have been defined of which at least one should be possessed by the advisors. Project evasion and risk evaluation have helped to understand the types of risk that are involved in the specific project. These risks are determined based on the provided examples. Thus it can be concluded that this report has helped to understand the primary finances that can prove vital for the companies to get enlisted in ASX.

Reference:

AHSAN, T., WANG, M. and MUHAMMAD, A.Q., 2016. How do they adjust their capital structure along their life cycle? An empirical study about capital structure over the life cycle of Pakistani firms. Journal of Asia Business Studies, 10(3), pp. 276-302. https://search.proquest.com/docview/1841760779/9E991A69327E4E1BPQ/1?accountid=30552

Aph.gov.au. 2020. Australia's General Insurance Industry. [online] Available at: <https://www.aph.gov.au/Parliamentary_Business/Committees/Senate/Economics/Generalinsurance/~/media/Committees/economics_ctte/Generalinsurance/c02.pdf> [Accessed 29 May 2020].

Asx.com.au. 2020. A Guide To Listing & The IPO Process In Australia. [online] Available at: <https://www.asx.com.au/documents/resources/A-Guide-to-Listing-SEP-18-Maddocks.pdf> [Accessed 29 May 2020].

Asx.com.au. 2020. Listing With ASX. [online] Available at: <https://www.asx.com.au/documents/resources/00080_Listing-with-ASX_Brochure_Dec-2016_07_final.pdf> [Accessed 29 May 2020].

Brokenhill.nsw.gov.au. 2020. Annual Financial Statements - Broken Hill City Council - NSW. [online] Available at: <https://www.brokenhill.nsw.gov.au/files/assets/public/annual-financial-statements-2019-audited.pdf> [Accessed 29 May 2020].

Capital.nab.com.au. 2020. 2019 Annual Financial Report - Capital And Funding. [online] Available at: <http://capital.nab.com.au/docs/2019-Annual-Financial-Report.pdf> [Accessed 29 May 2020].

Dai-ichi-life-hd.com. 2020. TAL And Australian Life Insurance Market. [online] Available at: <https://www.dai-ichi-life-hd.com/en/investor/pdf/2016_analyst_007.pdf> [Accessed 29 May 2020].

Fao.org. 2020. Agricultural Investment Funds For Developing Countries. [online] Available at: <http://www.fao.org/fileadmin/user_upload/ags/publications/investment_funds.pdf> [Accessed 29 May 2020].

Financialservices.royalcommission.gov.au. 2020. Search Results Web Results Some Features Of The Australian Banking Industry. [online] Available at: <https://financialservices.royalcommission.gov.au/publications/Documents/some-features-of-the-australian-banking-industry-background-paper-1.pdf> [Accessed 29 May 2020].

Financialservices.royalcommission.gov.au. 2020. Some Features Of The General And Life Insurance Industries. [online] Available at: <https://financialservices.royalcommission.gov.au/publications/Documents/some-features-of-the-general-and-life-insurance-industries-background-paper-26.PDF> [Accessed 29 May 2020].

Hannover-re.com. 2020. Group Insurance In Australia. [online] Available at: <https://www.hannover-re.com/913185/group-insurance-in-australia-2019.pdf> [Accessed 29 May 2020].

HARVEY, O., ALDRIDGE, C. and COHN-URBACH, B., 2015. INNOVATION AND REFORM IN AUSTRALIA'S financial market infrastructure: The Australasian Journal of Applied Finance. Jassa, (3), pp. 54-62. https://search.proquest.com/docview/1755758451/DF28709296C94EDAPQ/1?accountid=30552

JAMIL, S.A., AL ANI, M.K. and AL SHUBIRI, F.N., 2015. The Effect of Working Capital Management Efficiency on the Operating Performance of the Industrial Companies in Oman. International Journal of Economics and Financial Issues, 5(4),. https://search.proquest.com/docview/1729720542/F70D717FD591404BPQ/1?accountid=30552

JOHNSON, N.B., PFEIFFER, T. and SCHNEIDER, G., 2017. Two-stage capital budgeting, capital charge rates, and resource constraints. Review of Accounting Studies, 22(2), pp. 933-963. https://search.proquest.com/docview/1899649697/E9911AD8E2554939PQ/1?accountid=30552

Macquarie.com. 2020. Macquarie Group US Overview. [online] Available at: <https://www.macquarie.com/dafiles/Internet/mgl/com/us/campaigns/docs/MAQ105_USBrochure.pdf> [Accessed 29 May 2020].

Nyasha, S. and Odhiambo, N., 2020. The Australian Banking Sector Reforms. Corporate Ownership & Control, [online] 10(4), pp.469-478. Available at: <https://pdfs.semanticscholar.org/0abb/06cd3080146df8d6c00c189ac1f365ea9e41.pdf> [Accessed 29 May 2020].

Pwc.com.au. 2020. Future Of Banking In Australia. [online] Available at: <https://www.pwc.com.au/pdf/pwc-report-future-of-banking-in-australia.pdf> [Accessed 29 May 2020].

Rba.gov.au. 2020. Banks' Wealth Management Activities In Australia. [online] Available at: <https://www.rba.gov.au/publications/bulletin/2016/sep/pdf/rba-bulletin-2016-09-banks-wealth-management-activities-in-australia.pdf> [Accessed 29 May 2020].

Sec.gov. 2020. Search Results Web Results Regulation Of Investment Advisers. [online] Available at: <https://www.sec.gov/about/offices/oia/oia_investman/rplaze-042012.pdf> [Accessed 29 May 2020].

STEEN, A., MCGRATH, D. and WONG, A., 2016. Market Failure, Regulation and Education of Financial Advisors. Australasian Accounting Business & Finance Journal, 10(1), pp. 3-17. https://search.proquest.com/docview/1803796996/66BBA950FAC04BEEPQ/3?accountid=30552

TURNER, G. and NUGENT, J., 2015. INTERNATIONAL LINKAGES OF THE AUSTRALIAN BANKING SYSTEM: Implications for financial stability: The Australasian Journal of Applied Finance. Jassa, (3), pp. 34-43. https://search.proquest.com/docview/1755758106/945F09C7BF464919PQ/11?accountid=30552

TURNER, J.A., 2016. Net Operating Working Capital, Capital Budgeting, And Cash Budgets: A Teaching Example. American Journal of Business Education (Online), 9(1), pp. 31-n/a. https://search.proquest.com/docview/1765601523/E9911AD8E2554939PQ/2?accountid=30552