Macroeconomics Chapter 21 Problem set 1 Sample Assignment

- Which of the following transactions is considered a purchase of final output? Which one is considered the purchase of an intermediate good?

- Albert purchased a camera from the U.S. to use on his vacation in the Bahamas.

- Albert purchased a roll of film to use in his camera.

- An owner of a bakery purchased wheat to make bread

- A chocolate factory purchased milk to make chocolate.

- The Ford Company purchased 10 tons of steel to make cars.

- Sue purchased cleaning detergent to use in her newly purchased washing machine.

- Karen bought tomato seeds and planted them in her backyard for her own use.

- Choose the best answer of the following:

- GDP is defined as the market value of all ________ in a given time period.

- A) final goods produced in a country

- B) final goods and services produced by citizens of a particular country regardless of where in the world they are located

- C) final goods and services produced in a country by only the citizens of the country

- D) final goods and services produced in a country

- In the definition of GDP, "market value" refers to

- A) valuing production in production units.

- B) not counting intermediate products.

- C) valuing production according to the market price.

- D) when the production took place.

- If Nike, an American corporation, produces sneakers in Thailand this would

- A) count as part of U.S. GDP since it is a U.S. corporation.

- B) count for both Thailand's GDP and U.S. GDP.

- C) add to Thailand's GDP but not to U.S. GDP.

- D) add to neither U.S. GDP nor Thailand's GDP.

- Intermediate goods are excluded from GDP because

- A) their inclusion would involve double counting.

- B) they represent goods that have never been purchased so they cannot be counted.

- C) their inclusion would understate GDP

- D) the premise of the question is incorrect because intermediate goods are directly included in calculating GDP.

- A loaf of bread purchased by one of your instructors would be best described as

- A) an intermediate good.

- B) a financial asset.

- C) a used good.

- D) a final good.

- In computing GDP, it is essential to

- A) avoid double counting.

- B) include government transfer payments.

- C) include government tax revenues.

- D) count all intermediate products directly as they are produced.

- Grapes are

(a) Always counted as an intermediate good.

(b) Counted as an intermediate good only if they are used to produce another good like grapes cookies.

(c) Counted as an intermediate good only if they are consumed.

(d) Counted as an intermediate good whether they are used to produce another good or consumed.

- Double counting in the national income accounts will occur if GDP is computed by summing up:

- A) final output sales.

- B) value added.

- C) all sales.

D) the income earned by a country's residents.

- If Frito Lay, an American snack company, opens a new manufacturing facility in Mexico and produces snacks which are distributed in South America, then Mexico's GDP ________ and U.S. GDP ________.

- A) increases; does not change

- B) does not change; increases

- C) increases; decreases

- D) increases; increases

- The word "final" in the definition of GDP refers to

- A) not counting intermediate goods or services.

- B) the time period when production took place.

- C) valuing production at market prices.

- D) counting the intermediate goods and services used to produce GDP.

- Which of the following is a final good?

- A) the memory chips in your new smart phone

- B) a share of IBM stock

- C) flour purchased at the store to bake cookies

- D) flour used by the bakery to bake cookies

- Intermediate goods are excluded from GDP because

- A) their inclusion would involve double counting.

- B) they represent goods that have never been purchased so they cannot be counted.

- C) their inclusion would understate GDP

- D) the premise of the question is incorrect because intermediate goods are directly included in calculating GDP.

- Which of the following expenditures is for an intermediate good?

- A) The government buys new tires for its military vehicles.

- B) A U.S. tire firm sells new tires to Canada.

- C) General Motors buys new tires to put on the cars it's building.

- D) You buy new tires for your used car.

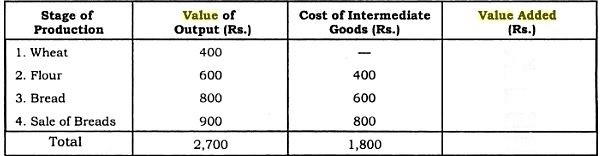

- Calculate the Value added in each stage of production in the above table.