Non Profit Organization Assignment Help

A non for profit organization refers to an organization which is formed by a group of people who works for a goal which is not profitable. Simply, intention of nonprofit organization is not to distribute excess of revenue over expenses to its members. It is formed for a particular social cause or for solving common problem of people. Even if they earn revenue in the course of their business, they reinvest it in their venture to further achieve their goals rather than distributing it to their members.

Although if we look at the nonprofit organization and not for profit organization, both will look same from the concept. But there are differences in legal and accounting procedure.

Member Serving type of Nonprofit Organization: - It is a type of organization which benefits the member of the organization. For example- mutual societies, cooperatives, trade unions, credit unions, industry associations, sports clubs, retired serviceman's clubs and advocacy groups or peak bodies.

Community Serving type of Nonprofit Organization: - This type of organization focuses on serving the community as whole either locally or globally.

Nonprofit organization uses the double bottom line approach where in organization focuses more on achieving their goals instead of earning profits though both are necessary for sustainability of the organization.

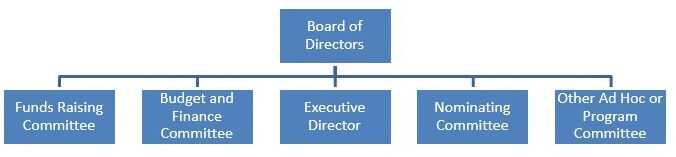

Organization Structure of NPO

Non Profit Organization Assignment Help By Online Tutoring and Guided Sessions from AssignmentHelp.Net

If an organization is nonprofit does not mean that it will not earn profits. But rather organization has no owner and fund realized in the operation will not be used to benefit any users.

Formation and Structure

Generally nonprofit organizations are formed by filling articles of association. Incorporation of the organization makes it a distinct body by law and allow them to enter in to business dealings, form contracts and own property as individuals.

NPO may have members. It is not important that NPO must have members to run. Organization is controlled by the Board of Directors, Trustee, elected by the members of the organization.

Tax Exemption

Government gives benefit to the organization of tax exemption. Nonprofit organization can apply to the income tax department of the company for exemption status. Exemption status will be provided to an organization only when the requirement of the provisions is fulfilled.

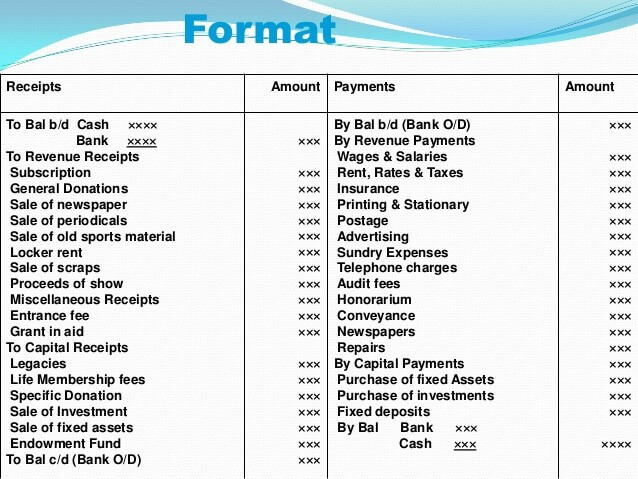

Receipts and Payment Account- It is more like a cash book only. It is an elementary form of account which is used by nonprofit organizations such as hospitals, clubs, societies, etc. It is used for presenting the results periodically. Though it is more like cash book but it shows the total of cash transactions under different heads.

It consists of cash transaction over a period of time including opening and closing cash balances. Receipts are shown on the left side and payment is shown on the right side. This account works on the rule ‘Debit what comes in, credit what goes out.’

Preparation of this account is done at the end of the accounting year. It does not take into account the amount which is not received by the organization. It does not matter whether they are of capital or revenue nature or related to previous or current year, if the organization has received the amount, it must come into this account.

Features-

- It is a summary of cash and bank transactions. Revenues are debited and Expenses are credited.

- Starts with opening cash or bank balance and ends with closing cash or bank balance.

- Not a part of double entry accounting system.

- Cash and bank receipts are recorded in this account irrespective of the relation of it with the year.

- Profit or Loss can’t be determined by this account since it includes cash transactions only not noncash items.

- It includes capital as well as revenue items also.

Illustration-

The receipts and payments for the DLF Club for the year ended Mar 31, 2017 were:

Entrance Fees- Rs 150

Membership fees- Rs 1500

Donation for Club Pavilion- Rs 5000

Foodstuff Sales- Rs 600

Salaries and Wages- Rs 600

Purchase of Food Stuff- Rs 400

Construction of Club Pavilion- Rs 5500

General Expenses- Rs 300

Rent and Taxes- Rs 200

Bank Charges- Rs 80

Cash in Hand at April 1, 2016- Rs 100; Mar 21, 2017- Rs 175

Bank Balance as on April 1, 2016- Rs 200; Mar 21, 2017- Rs 295

Solution:

DLF Club

Receipts and Payments Account

for the year ended Mar 31, 2017

| Receipts | Amt | Payment | Amt |

|---|---|---|---|

| To Cash in Hand B/D | 100 | By Salaries and Wages | 600 |

| To Bank Balance B/D | 200 | By purchase of food stuff | 400 |

| To Entrance Fees | 150 | By construction of club pavilion | 5500 |

| To Membership Fees | 1500 | By general expenses | 300 |

| To Donation of Account of Club Pavilion | 5000 | By rent and taxes | 200 |

| To Sales of Foodstuff | 600 | By bank charges | 80 |

| By Cash C/D | 175 | ||

| By Bank A/c C/D | 295 | ||

| Total | 7550 | Total | 7550 |

Limitations:

- a) It does not show account on accrual basis which may not represent the clear picture of the business at a point of time.

- b) It does not show whether the organization is able to meet its day to day expenses or not because it shows the amount of previous year or next year also. So it will be difficult for the business to ascertain.

- c) It does not take into account the expenses of non cash items.

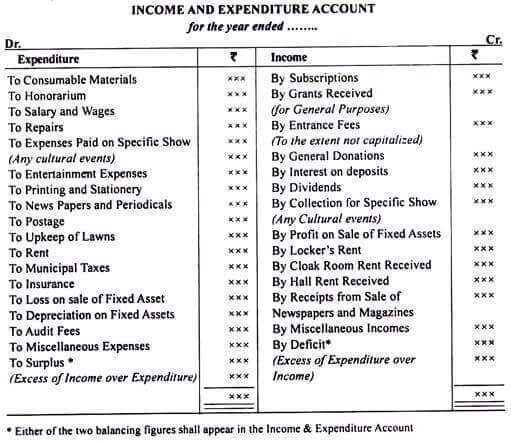

Income and Expenditure Account- Income and expenditure account is the profit and loss account of the NPOs. This account is prepared by non trading concerns who want to know if during the financial year their income has been more than their expenditure. It is prepared on the accrual basis. And capital nature revenue is excluded in the income and expenditure account. This account works on the rule ‘Debit all expenses and losses and credit all incomes and gains.’ Like the profit and loss account, expenses are recorded on the left side (debit side) and incomes are recorded on the right side (credit side). It doesn’t include the item of previous year. It includes items pertaining to current year only. All non cash items like depreciation, bad debts, provision for bad debts are taken into account.

Difference between the debit side and credit side is either surplus or deficit. If debit side exceeds credit side, it is deficit and if it goes other way around, it is surplus. Difference is then transferred to General Fund which appears in the balance sheet.

Features

- a) Revenue account prepared at the end of the financial year to find out the profit and loss amount.

- b) Prepared by matching the expenses with the revenues of a particular period.

- c) Cash as well as noncash items are taken into the account.

- d) Capital expenditures and receipts are excluded.

- e) Only current years’ income and expenses are considered, not previous or future year.

Sources of Income:

Subscriptions, donations, membership fees, entrance fees, income from investments etc. are the sources of income. Any amount of income raised for a special activity like sale of match tickets, is deducted from the expenditure of that activity and net amount is shown in income and expenditure account. Amount received from capital nature items will be transferred to capital fund and will not be shown in the income and expenditure account.

Examples:

- Hospitals- medicines, cost of investigations etc.

- Sports Club- sports material, tournament expenses etc.

- Drama Club- expenses of stage plays, rent of hall, payment to artists etc.

- Educational Societies- award of scholarships, organization of seminars etc.

If expenditure is incurred on the asset, it will be capitalized though depreciation charged every year will be taken as revenue item only.

Difference between Receipts and Payment Account and Income and Expenditure Account.

| Basis | Receipts and Payment Account | Income and Exp Account |

|---|---|---|

| Nature | Real Account | Nominal Account |

| Opening Balance | It starts with opening balance. | It does not start with opening balance. |

| Closing Balance | Ends with closing balance. | No closing balance. |

| Similarity | Cash Book | Profit and Loss Account |

| Capital and Revenue Item | Contains both the items. | Only consider revenue item. |

| Year | Consider previous, current and future year. | Only consider current year. |

| Basis | Cash Basis | Accrual Basis. |

| Balance Sheet | Not followed up by balance sheet. | It is followed up by balance sheet. |

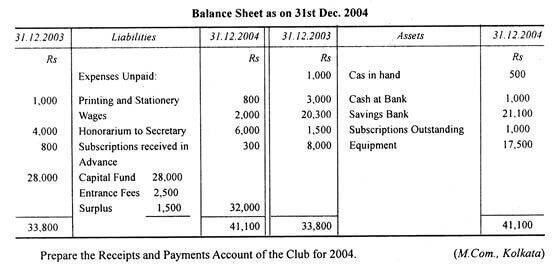

Balance Sheet- Balance sheet is the statement of assets and liabilities of an accounting unit at a given date. Preparation of balance sheet is done at the end of accounting year after the income and expenditure account has been prepared. Excess of total assets over total liabilities is known as Capital fund. Capital fund represents the amount contributed by the members. If contribution is not done from the side of members, it is known as accumulated fund.

The difference between the income and expenditure account is transferred to the capital fund. At the inception of a non-trading concern, there will be no formal Capital Fund and in such case, the Surplus, if any, earned during the year constitute the Capital Fund at the end of the year.

a) Donations- Charitable institutions may receive donations from time to time. If the collection is small and frequent, then it will be treated as income. Donations are also of two types:-

General Donation- Any donation received not for any specific purpose will be treated as general donation. General donation of small amount and frequent will be treated as income and if it is non-recurring in nature, then it will be added to the capital fund.

Specific Donation- Any donation which is received for some specific purpose will be treated as specific donation. Such amount cannot be used for any other purpose, except the purpose of donor. Therefore, such amount may be shown in Balance Sheet (liability side).

b) Legacy- It is also a kind of donation. But it is the amount given to non trading concerns as per the will of a deceased person. This type of receipt is of non recurring nature and is taken to the receipts and payment account as capital receipts.

c) Life Membership Fees- Organizations collect subscription as fees every month from their ordinary members. There are another category of members called ‘Life members’ from whom the fee is collected at lump sum.

d) Entrance Fees- This is the fees collected at the time of admission of the members. It is paid once by the member to become a part of the organization. Against treating it as an income, there are arguments favoring it as a capital receipt as the members pay such fees only once and therefore treat it as a capital receipt. In the absence of any instruction, it may be treated as an income and is credited to Income and Expenditure Account.

e) Sale of Old Sports Materials and Old newspapers- Amount received from the sale of old sports materials and old newspaper are of recurring nature and therefore treated as revenue incomes.

f) Purchase of Equipment- Price paid for purchase of any equipment is a capital expenditure.

g) Honorarium Paid- It is a payment of remuneration to a person who is not an employee of the organization. Such as any special performance is done, by an outsider, at the organization then the payment is honorarium and is taken to income and expenditure account as revenue expenditure.

h) Special Fund- If there is any specific fund, the expenses or incomes related to such fund will be adjusted to the fund itself (on the liabilities side). Such expenses or incomes may not be taken to income and expenditure account.

Budgeting for Nonprofits

Financial sustainability for any organization is so important, whether it is a nonprofit organization or trading organization. Board and staff make sure that timely review of the reports is done and advance planning is done for future. One way which could help in planning expenses and incomes of future is to prepare a budget. Approval of the annual budget is one of the fundamental building blocks of sound financial management.

Usually it is a job of staff members only to create a budget. But board members from executive or finance committee do look at the budget and review it. Once it is accepted by the board members, it is presented in the board meetings of the company.

Thus, the approved budget serves as a guide for financial activity for future. Using budget doesn’t mean that it is something written in stone, because a budget is just an estimation of the future expenses and incomes. In real life situation, it may happen that changes take place in the financial position of the business.

It is a guide which can help the NPO to plan for future and analyze its current position. Reviewing of budget should take place periodically to see whether things are going according to the plan or not. It may be necessary that the company would have to amend the budget in future.

It is generally a document that is referred many a times during a year by staff and board members. It is also referred by external parties like banks, donors who have financial interest in the company.

Cash or Accrual Basis?

Budget of the nonprofit organization can be both cash and accrual. But it is seen that cash basis is generally used for small organizations and accrual basis is used for organization who receive multi-year funding.

Conclusion- A nonprofit organization is a legal entity which works for the benefit of the society as a whole, rather than for the benefit of sole proprietor or a group of partners.

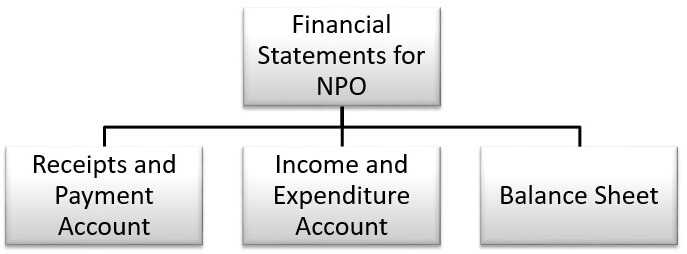

Financial Statements of NPO are:

a) Receipts and Payments Account- It is a summarized cash book.

b) Income and Expenditure Account- It is just another profit and loss account. It is prepared on the accrual principle and difference is referred as surplus or deficit.

c) Balance Sheet- Balance sheet of the nonprofit organization is compulsory for the organization. It tells the financial position of the company.

Donation, Entrance fees, Subscription, Life Membership fees are some sources of income for the nonprofit organization. These items have different treatments as some are treated as capital items and some are treated as revenue items. Some are treated on accrual basis and some are treated on cash basis.