Money Stock Assignment Help

Money Stock Measures: Monetary Aggregates

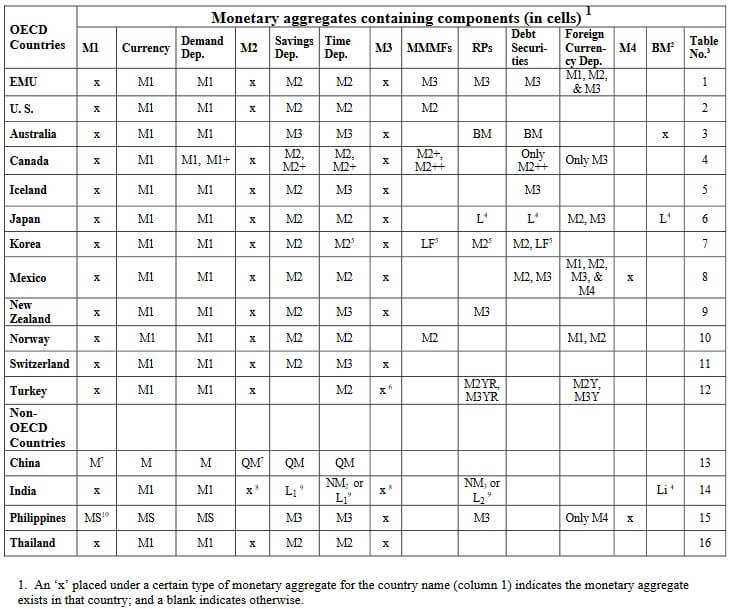

The debate on appropriate measure of money has evolved around the questions as to which financial assets should be included in measure of money. On one hand there are transaction theories of money which view money as essentially an inventory held for transaction purposes. This theory favours narrow measures of money.

On the other hand there is asset theories of money in which different financial assets are regarded as alternate ways of holding wealth. This theory favours broader measure of money. Different assets can be arranged in decreasing order of liquidity. Currency and demand deposits are the most liquid assets as they are medium of exchange. Time deposits and government bonds are liquid assets but cannot be converted into medium of exchange in a costless way. Assets such as real estate are most illiquid and cannot be immediately liquidated without incurring a large cost.

Monetary authorities provide various alternate measures of money. The classification of monetary aggregates is based on functional characteristics of monetary assets or institutional distinctions between banks and other financial intermediaries.

In USA there are 4 monetary aggregates M1 , M2, M3 and L.

M3 was discontinued in March 2006.

M1 and M2 are issued by depository institutions, Federal Reserve Banks for currency, and U.S. Treasury for coins. The Time deposits and certificates of deposits (CDs) are also classified on the basis of their denominations. TDs and CDs or less than $100,000 are known as small time deposits or small Certificate of Deposits. These are calculated as part of the non-M1 component of M2.

Money Stock Assignment Help By Online Tutoring and Guided Sessions at AssignmentHelp.Net

For denominations greater than $100,000 TDs and CDs, they are not counted in either M1 or M2.

The Money market mutual funds (MMMFs) held by individuals are known as retail MMMFs and are counted as part of the non-M1 component of M2.

The money market mutual funds held by large institutions are neither a part of M1 nor M2.

In India, money stock measures range from M1 to M4, defined as:

(Higher is the number attached to M, greater is the range of financial assets included and larger is the measure).

M1

M1 is the narrow measure of money and reflects mainly the medium of exchange function of money. It is defined as:

{`

M1 = Currency (with public) +

Demand deposits +

Other deposits with reserve bank of India

`}

M2

{`

M2 = M1 +

Saving deposits with post office savings bank

`}

M3

{`

M3 = M1 +

time deposits

`}

M4

{`

M4 = M3 +

All deposits with the Post office savings organisation

`}

The distinction between M1 and M3 are based on separation of time deposits with banks (which are less liquid). Also the distinction between M1 and M3 on one hand and M2 and M4 is based solely on institutional difference between banks and post office savings organisation.

Image reference:- https://www.federalreserve.gov/pubs/feds/2007/200702/200702pap.pdf

New Monetary Aggregates and Liquidity Aggregates proposed by Reddy Committee for India (1998)

During liberalisation of 1990s, banks in India resorted to non-traditional sources for funds under increasing competitive pressures. Also the distinctions between operations of different financial institutions was blurred. Thus the monetary aggregates from M1 to M4 were revised by the Working Group on Money Supply: Analytics and Methodology of compilation chaired by Dr YV Reddy in 1998. The working group observed that the monetary aggregates were not in conformity with the norms of progressing liquidity.

The working group thus suggested new monetary and liquidity aggregates (NM0 through NM3 and L1 through L3).

The key features of new monetary aggregates are:

1. Recognising there is no unique definition of money, the working group for policy purpose defined money as a set of financial aggregates whose variations could impact the overall economic activity.

2. These new aggregates are based on the residency criterion in conformity with the recommendations obtained in the monetary & Financial Statistics Manual of IMF. The IMF’s manual recommends exclusion of non-resident deposits from monetary aggregates because such deposits are used for international transactions rather than domestic transaction. But if they are to be used for domestic transactions at home, these deposits must be included in money. Thus, based on these principles, non-resident foreign currency deposits have been excluded from the monetary aggregates. However non-resident Rupee denomination deposits have been retained as part of monetary aggregates as these are integrated with the domestic financial system.

3. The definition of bank credit to commercial sector was broadened to include the ‘non-SLR investments’ (investment in securities such as commercial papers, shares, debentures issued by commercial sector besides conventional bank credit.

4. Foreign currency liabilities of banks have been identified explicitly to make accurate compilation of bank’s net foreign assets. A capital account comprising of capital and reserves and revaluations has been separately identified.

5. The working group recommended introduction of liquidity aggregates in order to provide broader magnitudes of monetary and near money liabilities issued by Non-banking financial institutions which compete with money in public’s holding of liquidity claims.

6. Postal deposits have been excluded from monetary aggregates and are now a part of liquidity aggregates.

7. The deposit liabilities of non-bank financial institutions are not monetary assets and thus were made part of broader liquidity assets.

The monetary aggregates were differentiated from liquidity assets not on the basis of instruments but on the nature and functioning of institutions issuing them.

The new Monetary and Liquidity aggregates in India were thus defined NM0, NM1, NM2, NM3 and L1, L2, L3 as shown below

{`

NM0 = Monetary Base

= currency in circulation

+ Bankers deposits with RBI

+ 'other deposits' with the Reserve Bank of India

NM1 = currency (with public)

+ demand deposits with the banking system

+ 'other deposits with the Reserve Bank of India

NM2 = NM1

+ time liability portion of savings deposits

+ certificates of deposits

+ Term deposits (excluding foreign currency deposits with a contractual maturity of up to one year with the banking system

NM3 = NM2

+ Term deposits (excluding foreign currency deposits with a contractual maturity of over one year with the banking system

+ call borrowings from 'non-depository financial corporations' by the banking system

L1 = NM3

+ all deposits with the post office saving banks (excluding National Savings Certificates)

L2 = L1

+ term deposits with term lending institutions and refinancing institutions

+ certificates of deposits issued by financial institutions

L3 = L2

+ public deposits of non-bank financial companies

`}

Chetty’s Weighted Monetary Aggregates based on degree of Moneyness

Chetty argued that each monetary asset has a certain degree of ‘moneyness’ to it. It is not important to know which monetary stocks should be included in the measure of money stock but how much of each asset should be included. Thus a logical approach is to construct monetary aggregates covering all monetary assets, weighted by their degree of moneyness.

Fundamentally money stock in an economy should be a quantity aggregate that reflects the source of monetary services that can be generated in the economy. Since the monetary services are provided by all monetary assets including currency, demand deposits, savings deposits, time deposits and so on. Thus it is necessary to combine the monetary services of each of these assets into one or more aggregates.

The simple sum aggregates have two flaws:

1. The simple sum aggregates assign equal sum to all components which is inconsistent with economic theory. A meaningful measure would be a weighted sum aggregate, with weights reflecting relevant value shares.

2. Simple sum aggregates would be justified in terms of economic theory only if they were perfect substitutes of each other (that is the elasticity of substitution between any pairs would be infinite). Thus a simple sum of currency and time deposits would only be justified if their degree of moneyness was the same. However, simple sum aggregates treat such distant (imperfect) substitutes for currency as perfect substitutes, which is unjustified and distorts monetary aggregates.

However there are also many problems associated with constructing weighted monetary aggregates.

1. There are several conceptual, empirical and practical problems in translating the introcontrovertible principle into numbers, especially in developing and emerging market economies (EMEs)

2. In India, attempts have not succeeded in creating weighted monetary aggregates that outperform simple monetary aggregates. This also reflects deficiencies of operationalisation rather than conceptualisation.