Free Cash Flow to Equity

FREE CASH FLOW TO EQUITY DISCOUNT MODEL

Basically, the free cash flow to equity is a measure of how much the cash can be paid to the equity shareholder of the company after all the expenses, reinvestment and debt are paid. As we all know that the equity shareholder gets the return on its investment after payment of all the expenses which are held by the company. The free cash flow to equity is a measure of equity capital usage.

This is a technique or the way which is often used by the analysts in an attempt to determine the value of the company. This method used to determine the amount of the equity share holder not the amount to be paid to each equity share holder.

The free cash flow to equity is composed of the following items

- Net Income

- Net Capital Expenditure (Capital expenditure – depreciation)

- Net Working Capital (Current Assets - Current Liabilities)

- Debt

It is calculated as

FCFE = Net Income – Net capital Expenditure – change in the net working capital + New debt – Debt repayment.

In this chapter we will discuss the reason for difference between dividend and free cash flow to equity.

Basically, the firm will pay to its shareholder the amount after payment of all its debt and capital expenditure and other expenses.

If there is preferred dividend then the calculation of the free flow of equity will be as follows

Free Cash Flow to Equity (FCFE) = Net Income - (Capital Expenditures - Depreciation) - (Change in Non-cash Working Capital) – (Preferred Dividends + New Preferred Stock Issued) + (New Debt Issued - Debt Repayments)

Comparing Dividends to Free Cash Flows to Equity

Dividend is a type of remuneration which has to be paid by the company to its existing shareholder.

The dividend pay-out ratio is the amount of dividends paid to stockholders relative to the amount of total net income of a company. The amount that is not paid out in dividends to stockholders is held by the company for growth.

The dividend Pay-out ratio is calculated as follows

Dividend Pay-out ratio = Dividend/Earning

Cash to stockholders to FCFE ratio = Dividend + Equity repurchase /FCFE

This ratio of cash to FCFE to the stakeholder show that how much of cash is available to be paid out to stockholder is actually returned to them in the form of dividend and stock buyback.

The tendency of firms to pay out less to stockholders than they have available in free cash flows to equity by examining cash returned to stockholders paid as a percentage of free cash flow to equity.

A percentage less than 100% means that the firm is paying out less in dividends than it has available in free cash flows and that it is generating surplus cash. A percentage greater than 100% indicates that the firm is paying out more in dividends than it has available in cash flow.

There are various reasons why the firms may pay out less than is available:

1) Desire for stability

If the firm is making a higher dividend in the subsequent year, the firm rather than giving a higher dividend to its shareholder, it tends to retain it as for the uncertainty of their capacity to make a dividend in coming year. Firm tires to be stable in their dividend payment policy throughout the years.

2) Future Investment Needs

A firm tries to hold the payment of its entire FCFE as dividend due the requirement of the capital expenditure needs in the subsequent years. Thus for its future needs, the firm tries to retain some of its dividends for its future capital expenditure needs.

3) Tax Factors

If the dividend is taxed at a higher tax rate than the capital gain, the firm pay much less in dividend as available with them and retain the excess cash and vice versa.

Tax is a very important and essential factor that influences the payment or distribution of the dividend to the existing stockholder.

4) Signalling Prerogatives

Basically the firm uses the dividends distribution as a signal for the future prospects, basically the increase in the dividend being viewed as a positive signal and the decrease in the dividend is viewed as a negative signal. The use of dividends as sign may lead to difference between dividends and FCFE.

5) Managerial Self-interest

If the manager tries to retain the gain in the form of cash rather than paying the cash out as a dividend to its stockholder, it is called for the self-interest of its own or for the firm future prospective.

FCFE Valuation Models

Basically, the free cash flow of equity represents a valuation model in which we discount the potential dividends rather than the actual dividends.

If we replace the dividends with the free cash flows to equity to value equity, there can be two consequences –

1) If we follow the free cash flow to equity model, we will not have a future cash build up for the firm because in the FCFE model the cash which is left after payment of all the debts and expenses are directly paid to the equity shareholder.

2) In the free cash flows to equity model, the growth is related directly to the growth in income from the operating assets rather than the growth in income

Estimating Growth in Free Cash Flows to Equity

Basically, the growth in Free Cash Flows to Equity is estimated in order to get the expected growth rate.

Expected growth rate is calculated as follows:

Expected growth rate = Retention Ratio * return on equity.

The expected growth ratio is replaced by the equity investment rate, which basically measure the percentage of the net income that is invested back into the firm.

Equity reinvestment rate = 1 - Net capital Ex + change in working capital - New debts issue/Net Income

Basically the return on equity measure the conventional return which includes interest income from cash and marketable securities in the numerator and the book value of equity includes the value of cash and marketable securities.

In the FCFE model, there is no excess cash left in the firm and the return on equity should measure the return on non-cash investments.

Non Cash ROE = Net icome - After tax income from cash and marketable securities / Book value of Equity - Cash and marketable securities

Expected growth in FCFE = Equity reinvestment rate * Non-Cash ROE

The constant growth FCFE mode

The constant growth FCFE model is designed to value firms that are growing at a stable rate.

{`

It is calculated as:

Po = FCFE / Ke - gn

Po = Value of stock today

FCFE = Expected FCFE of next year

Ke = Cost of Equity of the firm

gn = Growth rate in FCFE for the firm forevermore

`}

To estimate the reinvestment for a stable growth firm, there are basically two approaches:

1) Use the typical reinvestment rates for the firms in the industry to which the firm belongs. A simple way to do this is to use the average capital expenditure to depreciation ratio for the industry.

2) We use the relationship between growth and fundamental developed to estimate the required investment .The expected growth in net income – Expected growth rate in Net income = Equity reinvestment rate * return on equity

Equity reinvestment rate - Expected growth rate / Return on equity

Let us understand with a help of an example:

Suppose the Expected growth rate is 4% while the Return on equity is 12%

{`

Equity reinvestment rate = Expected growth rate / Return on equity

= 4% / 12%

= 33.34%

`}

This model, like the Gordon growth model, is best suited for firms growing at a rate comparable to or lowers than the nominal growth in the economy.

The Two-stage FCFE Model

The two stage FCFE model is designed to value a firm which is expected to grow much faster than a stable firm in the initial period and at stable rate at the end.

Basically the value of any stock is the present value of the FCFE plus the value at the terminal price

{`

It is calculated as follows:

Valuation in two stage FCFE Model = PV of the FCFE + PV of terminal Price

Value = ∑ FCFEt / (((1+Ke )t ) )+ Pn / (1+Ke )n

FCFEt = Free Cashflow to Equity in year t

Pn = Price at the end of the extraordinary growth period

Ke = Cost of equity in high growth (hg) and stable growth (st) periods

`}

The terminal price is generally calculated using the infinite growth rate model:

{`

P n = ∑ FCFEn+1/r- gn

where

gn = Growth rate the terminal year forever

`}

Calculating the terminal price

The terminal value of the asset is calculated at the end of the year when it assumes that the assets will give a stable return. The terminal value (TV) captures the value of a business beyond the projection period in a DCF analysis, and is the present value of all subsequent cash flows.

The beta and debt ratio may also need to be adjusted in stable growth to reflects that the stable growth firm tends to have average risk.

Let us take the example of capital expenditure, depreciation and the growth rates:

XYZ ltd is a firm that is expected to have earnings growth of 20% for the next five years and 5% thereafter. The current earnings per share is $4.50. Current capital spending is $3.00 and current depreciation is $2.00. We assume that capital spending and depreciation grow at the same rate as earnings and there are no working capital requirements or debt

We are given that the free cash flow to equity in year 5 will have growth rate of 20%, current earning per share is $4.50 and Current capital spending is $3.00 while the current depreciation is $2.00

Free Cash Flow to Equity (FCFE) = Net Income - (Capital Expenditures -Depreciation) - (Change in Non Cash Working Capital) – (Preferred Dividends + New Preferred Stock Issued) + (New Debt Issued - Debt Repayments)

Earnings in year 5 = $4.50 * (1.20)^5 = $ 11.19

Capital spending in year 5 = $3.00 * (1.20)^5 = $ 7.46

Depreciation in year 5 = $2.00 * (1.20)^5 = $ 4.97

Free cash flow to equity in year 5 = $ 11.19 + $4.97 - $7.46 = $8.7

we can calculate the free cash flow to equity in the terminal year as = $8.70 * (1.05) = $9.135

This free cash flow to equity can then be used to compute the value per share at the end of year 5, but it will understate the true value. There are two ways in which you can adjust for this:

1) Adjust capital expenditures in year 6 to reflect industry average capital expenditure needs: Assume, for instance, that capital expenditures are 150% of depreciation for the industry in which the firm operates. You could compute the capital expenditures in year 6 as follows:

Depreciation in year 6 = $4.97 (1.05) = $5.2185

Capital expenditures in year 6 = Depreciation in year 6* Industry average capital expenditures as per cent of depreciation = $5.2185 *1.50 = $7.82775

FCFE in year 6 = $11.19 + $5.2185 - $7.82775 = $8.58075

2. Estimate the equity reinvestment rate in year 6, based upon expected growth and the firm’s return on equity. For instance, if we assume that this firm’s return on equity will be 15% in stable growth, the equity reinvestment rate would need to be:

Equity reinvestment rate = g/ROE = 5%/15% = 33.33%

Net Capital expenditures in year 6 = Equity reinvestment rate * Earnings per share

= 0.3333* $ 11.19 = $3.729

FCFE in year 6 = $11.19 - $3.729 = $7.461

The two stage FCFE model makes some assumption regarding the growth, i.e. that growth will be high and constant in the initial period and drop abruptly to stable growth after that.

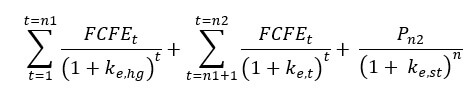

The E-Model: A Three Stage FCFE Model of Valuation

The E model is designed to value firms that are expected to go through three stages of growth

- An initial phase of high growth rates

- A transitional period where the growth rates declines

- A steady state period where growth is stable

It is denoted as follows

{`

Where,

P0 = Value of the stock today

FCFE_t = FCFE in year t

ke,t = Cost of Equity

Pn2 = Terminal price at the end of transitional period = ∑ FCFEn2+1 / r- gn

N1 = End of initial high growth period

N2 = End of transition period

`}

Basically in this model we assume that the growth rate goes through three distinct phases

1) High growth 2) Transitional growth 3) stable growth

Basically, the model allows for three stages of growth and the for a gradual decline from the high to stable growth, it is the appropriate model to use to value firm with very high growth rates currently.

Comparison of Free Cash Flows to Equity Valuation versus Dividend Discount Model Valuation

The discounted cash flow model that uses FCFE can be viewed as an alternative to dividend discounted model.

Case 1: When FCFE and dividend discount valuation model are similar

There are two conditions under which the value which is calculated from the Free Cash Flows to Equity in discounted cash flow valuation will be exactly same as the value of the dividend discounted model. One is when the dividend is equal to the FCFE and the second is when FCFE is greater than dividends, but the excess cash (FCFE Dividends) is invested in project with net present value of zero.

Case 2: When Free Cash flows to equity and dividend discount model valuations are different

- Firstly, in the case the FCFE is greater than the dividend and the excess cash either earns below-market interest rates or is invested in negative net present value projects, the value from the FCFE model will be greater than the value from the dividend discount model.

- Secondly, the payment of dividends less than FCFE lower debt equity ratios and may lead the firm to become under levered, causing a loss in value.

- Thirdly the assumption is related to the reinvestment and growth in the two models. If the same growth rate used in the dividend discount and FCFE models, the FCFE model will give a higher value than the dividend discount model whenever FCFE are higher than dividends and a lower value when dividends exceed FCFE. Basically, the growth of FCFE is different from that of dividend growth, because the free cash flow of equity is assumed to be paid out of stockholder.

What does it mean when the valuation from free cash flows to equity is different from the dividend discount model valuation?

Most commonly, the value of the FCFE model exceeds the value of dividend discount model.

The difference between these two models can be considered one component of the value of controlling a firm – it measures the value of controlling dividend policy.

The final decision making of whether to choose the dividend discount model or the FCFE model depends on various factors:

- Profitability

- Firm Size

- Market Conditions

- Legal restriction

- Market Price

Do my Finance Assignment: Online Finance Help for Students

Assignmenthelp.net offers best, reliable and the most affordable online finance homework help for high school, college and university students. Whether you need finance help with CAPM model, enterprise Risk Management, capital budgeting tools or help with problems based on how to calculate free cash flows to equity and other valuation tools; our online finance homework help tutors are always available to help students with their finance homework answers. Finance is a difficult subject for most students as it contains tough numerical problems and difficult exercises. However, with the right finance tutors, understanding even the most complex finance models can become an easy task for students. That is why we recommend all university and college students to take help with our online finance tutors and corporate finance tutors for solutions to homework problems, finance research papers, finance term papers, financial statement analysis assignments and other finance related homework assignments to get good marks in their finance subject classes.