Gordon Growth Model dividends

Whenever an investor trends to purchase an asset, the basic things to be considered is what an investor is willing to pay and what the investor actually received. The expectation of the investor in return is the future cash flow in the form of dividend and value of asset when it is sold.

The value of the stock/ assets remains same and there is a variation in the dividend amount which we paid to the shareholder as there cash inflow.

Basic Dividend Valuation Model

Basically, the basic dividend valuation model is the model which determines the current value of the stock or asset to that of the future cash flow. It is done by discounting the future cash flow with the discounted value of the current year. The intrinsic value is the actual value of a company or an asset based on an underlying perception of its true value including all aspects of the business, in terms of both tangible and intangible factors.

In the case where the dividends are constant forever, the value of the stock in the present value of the dividend per share per period is perpetuity. Current price of a share of common stock, Po

Po = D1 / r

The required rate of return is the compensation for the time value of money tied up in their investment and the uncertainty of the future cash flows from these investments.

The greater the uncertainty, the greater the required rate of return.

Let us understand by an example –

If the current dividend is $10 per share and the required rate of return is 10 percent, the value of a share of stock is $100. Therefore, if you pay $100 per share and dividends remain constant at $10 per share, you will earn a 10 percent return per year on your investment every year.

Gordon Model for Dividend valuation

Basically dividend is the cash distribution by the company to its shareholder.

The dividend Valuation model (DVM) is a method of valuing a company's stock price based on the theory that its stock is worth the sum of all of its future dividend payments, discounted back to their present value. In other words, it is used to value stocks based on the net present value of the future dividends . It is the key valuation method for dividend stocks.

{`

It is calculated as follows

The growth of the cash flow is denoted by g

Return on Equity – r

This period dividend - Do

So the dividend Valuation model (DVM) is calculated as follows –

DVM = Do(1+g) /(r-g)

Basically this model is also called as Gordon model.

`}

The required rate of return is the return demanded by the shareholders to compensate them for the time value of money and risk associated with the stock’s future cash flows.

Let us consider the Gordon Model with an example:

1) XYZ ltd paid a dividend on a stock today are $10 per share and dividends are expected to grow at a rate of 5% per annum. If the required rate of return is 10% what is the value of a share of stock.

{`

Solution – Dividend Discounted model

DVM = Do(1+g) /r-g

DVM = $10(1+0.05)/.10-.05

DVM = $210

`}

2) ABC XYZ ltd paid a dividends on a stock today are $6.8 per share and dividends are expected to grow at a rate of 2% per annum. If the required rate of return is 5% what is the value of a share of stock.

{`

Solution – Dividend Discounted model

DVM = Do(1+g) /r-g

DVM = $6.8(1+0.02)/.05-.02

DVM = $231.2

`}

Many mature companies will have dividends that grow at a constant rate through time. Companies that pay dividends generally think such that the dividend does not decrease. The Reason shareholders who receive dividend from a company expect the company to either maintain the current dividend per share or increase it. Companies that cut dividends generally lead to a fall in stock price. Companies are hesitant to decrease dividends and will only raise them if they are confident that they can maintain the higher level of dividends.

Companies that pay dividends generally have policies with respect to the dividend per share such as maintaining a constant or increasing dividend per share. Companies do not include the dividend to earnings because this would result in dividends changing each period, with occasional decreases.

Non-constant growth in dividends

When the company is in its starting stage it earns a good profit with a rapid growth in the developing stage and the growth start declining as the company come to the maturity stage and full decline in the final stage of its existence. So there is a non-constant growth of dividend in the company.

Two-stage dividend growth models

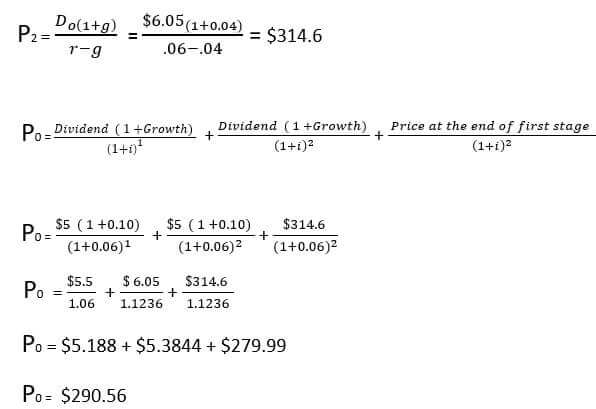

In the two-stage model, we calculate the present value of dividend as well as the present value of price at the end of two year.

Let us understand with the help of an example –

ABX ltd offer a current dividend of $ 5.00 per share and expected to grow at a rate of 10% per year and afterward at a rate of 4%. The required are of return is 6%.

Solution – Firstly we have to calculate the price at the end of the first stage.

This is a twostage growth model for dividend valuation. The basic difference is that the dividend valuation model is used to determine the price beyond which there is constant growth, but the dividends during the first growth period are discounted using basic cash flow discounting.

The Three-stage dividend growth model

Basically, in every company life cycle, there are 3 stages

- Development Stage with a High Growth

- Maturity Stage with a Moderate Growth

- Declining Phase with Little, No or Negative Growth

This pattern encourages the use of a three-stage model for the valuation of a company’s equity.

The H Model

The H model assumes that the earnings and dividends of the firm do not suddenly fall off a cliff when the horizon period ends. Rather, the decline in the growth rate is a gradual process. The H- Model is used to value a stock when it is assumed that the dividend growth will change from one growth rate to another in a linear manner.

It is calculate as follows –

{`

V0 = D0 * (1+gn)/r-gn + D0 * H * ( ga+ gn)/(r- gn)

D0 * (1+gn)/r-gn = Value of normal growth

D0 * H * ( ga + gn )/( r- gn ) = Added value from abnormal growth.

`}

Let us take an example

A common stock whose dividend is currently $10.00 per share and is expected to grow at a rate of 10 per cent per year and after four years is at a rate of 4 per cent per year. Assuming a required rate of return of 6 per cent, the value of a share of stock is:

Solution -

{`

V0 = D0 * (1+gn)/r-gn + D0 * H * ( ga + gn)/(r- gn)

V0 = $10* (1+0.04)/0.06-0.04 + $10 * 2.5 * (0.1+ 0.04)/(0.06-0.04)

V0 = $520 + $75 = $595

Therefore $ 520 of the current value is due to the underlying, normal growth and abnormal growth $75.

`}

The Uses of the Dividend Valuation Models

Basically the dividend valuation model is used to value stock based on the net present value of the future dividend. One of the benefits of the Dividend Valuation Model is that we use dividends to value the company, which is a tangible return to the investor. It doesn’t give the total value of the entity though as debt is not included.

The price earnings ratio is also known as the price to earnings ratio or PE Ratio. It is the ratio of the company stock price to the company earning per share. The ratio is used in valuing company.

{`

It is calculated as follows

P0 = today’s price,

P0 = current earnings per share,

P0 = current dividend per share,

g = expected growth rate

r = required rate of return.

`}

If we take the Dividend Valuation Model and divide both sides by earnings per share we will get

P0/E0 = D0/E0 (1+g)/r-g

It is also denoted as Dividend payout ratio ( 1+g)/r-g

The PE ratio is directly related to the dividend payout [So an increase in the dividend payout leads to an increase in the PE ration. A decrease in the dividend payout leads to a decrease in the PE ratio]

The PE ratio is Inversely related to the required rate of return which means that with an increase in the rate of return the PE ratio declines. With a decrease in the rate of return, the PE ratio increases.

The PE ratio is directly related to the rate of growth. Thus, when there is an increase in the rate of growth the PE ratio increases and when there is a decrease in the rate of growth, the PE ratio declines.

Required rate of return is calculated as follows r = D0/P0 +g

The required rate of return is comprised of the dividend yield and the growth of rate is called capital yield.

We can relate the dividend valuation model with the price book value ratio (i.e. the ratio to the price value of share to the book value per share)

P0 = Do(1+g) /r-g = (D0/E0 ) * E0 (1+g)/r-g because D0/P0 * E0 = D0

B0 indicate the current book value per share and ROE0 indicate the current return on book equity,

So the ratio of earning to the book value of equity

E0 = B0 * ROE0

P0 = B0 * ROE0 (D0/E0) (1+g))/r-g

The price of a stock to book value, the return on equity, the dividend payout, the required rate of return, and the growth rate have the following relation:

{`

Increase B0 → Increase P0

Increase ROE0 → Increase P0

Increase D0/E0 → Increase P0

Increase g → Increase P0

Increase r → Decrease P0

`}

Therefore the dividend valuation model, along with our knowledge of financial relations (i.e., financial statements and financial ratios), to relate the stock’s price and price multiples to fundamental factors.

Stock Valuation and Market Efficiency

In the financial markets, the stock valuation is the method of calculating theoretical value of the companies and their stock. Stock valuation is of two types. One is a value created using some type of cash flow, sales or fundamental earnings analysis. The other value is dictated by how much an investor is willing to pay for a particular share of stock and by how much other investors are willing to sell a stock for (in other words, by supply and demand).

Valuation is the process of determining what something is worth at a point in time.

In case if the market is efficient, it means that the price today reflects all available information. It concern with the future cash flows and their risk

The implication of efficient markets is basically that technical analysis will not be profitable. It also means that the fundamental analysis , while valuable in term of evaluating future cash flows , assessing risk and assisting in the proper selection of investment for a portfolio.

The dividend valuation model can be related to fundamental factors that drive the value of a company’s equity, including the return on equity and the dividend payout.