Balance of Payments

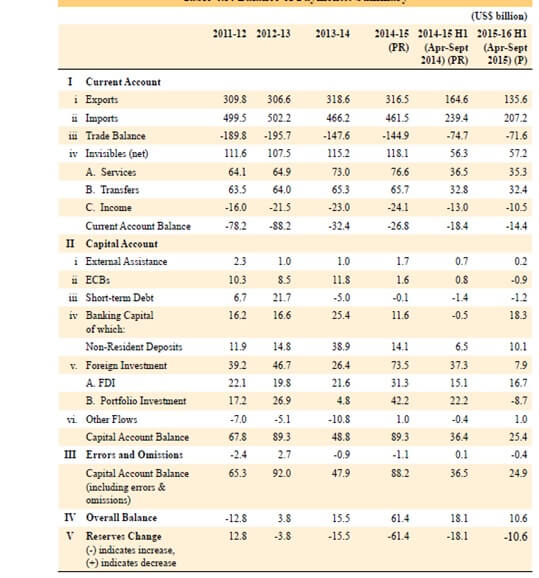

BALANCE OF PAYMENTS COMPONENTS EXAMPLE (INDIA)

Balance of Payments (BoP) is a statistical statement that systematically summarises, for a specific time period, the economic transactions of an economy with the rest of the world. Transactions between residents and non-residents consist of those involving goods, services, and income; involving financial claims on and liabilities to the rest of the world; and those classified as transfers, involving offsetting entries to balance one-sided transactions.

The basic structure and components of the Balance of Payments (BOP) of India consists of:

- (i) Current account: exports and imports of goods, services, income (both investment income and compensation of employees) and current transfers;

- (ii) Capital account: assets and liabilities covering direct investment, portfolio investment, loans, banking capital and other capital;

- (iii) Statistical discrepancy;

- (iv) International reserves and IMF transactions.

1.1. Components of Current Account

1.1.1. Merchandise Trade

Merchandise credit relates to export of goods while merchandise debit represent import of goods.

1.1.2. Services

Services receipts and payments include:

1.1.2.1. Travel

Travel represents all expenditure by foreign tourists in India on the receipts side and all expenditure by Indian tourists abroad on payments side. Travel receipts largely depend on the arrival of foreign tourists in India during a given time period.

1.1.2.2. Transportation

‘Transportation’ records receipts and payments on account of the carriage of goods and natural persons as well as other distributive services (like port charges, bunker fuel, stevedoring, cabotage, warehousing, etc.) linked to merchandise trade.

1.1.2.3. Insurance

‘Insurance receipts’ consist of insurance on exports, premium on life and non-life policies and reinsurance premium from foreign insurance companies. Insurance on exports is directly related to total exports from India.

1.1.2.4. Government not included elsewhere (GNIE)

‘Government not included elsewhere (GNIE)’ receipts represent inward remittances towards maintenance of foreign embassies, diplomatic missions and offices of international/regional institutions in India, while GNIE payments record the remittances on account of maintenance of Indian embassies and diplomatic missions abroad and remittances by foreign embassies on their account.

1.1.2.5. Miscellaneous

‘Miscellaneous services’ comprise of a host of business services, viz., communication, construction, financial, software and news agency services, royalties, copyright and license fees, management services and others. Of late, data on software services – receipts and payments, are presented separately.

1.1.3. Transfers (Official, Private)

Transfers represent one-sided transactions, i.e., transactions that do not have any quid pro quo, such as grants, gifts, and migrants’ transfers by way of remittances for family maintenance, repatriation of savings and transfer of financial and real resources linked to change in resident status of migrants. Official transfer receipts include grants, donations and other assistance received by the Government from bilateral and multilateral institutions. Similar transfers by Indian Government to other countries are recorded under official transfer payments.

1.1.4. Income

Transactions are in the form of interest, dividend, profit and others for servicing of capital transactions. Investment income receipts comprise interest received on loans to nonresidents, dividend/profit received by Indians on foreign investment, reinvested earnings of Indian FDI companies abroad, interest received on debentures, commercial Papers (CPs), fixed deposits and funds held abroad.

Investment income payments comprise payment of interest on non-resident deposits, payment of interest on loans from nonresidents, payment of dividend/profit to nonresident shareholders, reinvested earnings of the FDI companies, payment of interest on debentures, CPs, fixed deposits, Government securities etc.

1.2. Components of Capital Account

The data on capital account include reporting on foreign direct investment, foreign institutional investment, external commercial borrowing (ECBs)/foreign currency convertible bonds (FCCBs), trade credit, NRI deposits and other banking liabilities/assets.

1.2.1. Foreign Investment

Foreign investment has two components, namely, foreign direct investment and portfolio investment. Foreign direct investment (FDI) to and by India up to 1999-2000 comprise mainly equity capital such as equity of unincorporated entities (mainly foreign bank branches in India and Indian bank branches operating abroad) and equity of incorporated bodies.

1.2.2. Portfolio Investment

Portfolio investments mainly include FIIs’ investment, funds raised by Indian companies and through offshore funds. Data on investment abroad have been split into equity capital and portfolio investment since 2000-01.

1.2.3. External Assistance

External assistance by India denotes aid extended by India to other foreign Governments under various agreements and repayment of such loans. External Assistance to India denotes multilateral and bilateral loans received under the agreements between Government of India and other Governments/International institutions and repayments of such loans by India, except loan repayment to erstwhile “Rupee area” countries that are covered under the Rupee Debt Service.

1.2.4. Commercial Borrowings

Commercial borrowings cover all medium/long term loans. Commercial Borrowings by India denote loans extended by the Export Import Bank of India (EXIM bank) to various countries and repayment of such loans. Commercial Borrowings - to India denote drawls/ repayment of loans including buyers credit, suppliers credit, floating rate notes (FRNs), commercial paper (CP), bonds, foreign currency convertible bonds (FCCBs) issued abroad by the Indian corporate, etc.

1.2.5. Short-Term Loans to India

It is defined as the drawls in respect of loans, utilized and repayments with a maturity of less than one year.

1.2.6. Banking Capital

It comprises three components: a) foreign assets of commercial banks, b) foreign liabilities of commercial banks, and c) others. ‘Foreign assets’ of commercial banks consist of (i) foreign currency holdings, and (ii) rupee overdrafts to non-resident banks.

‘Foreign liabilities’ of commercial banks consists of (i) Non-resident deposits, which comprises receipt and redemption of various non-resident deposit schemes, and (ii) liabilities other than non-resident deposits which comprises rupee and foreign currency liabilities to non-resident banks and official and semi-official institutions. ‘Others’ under banking capital include movement in balances of foreign central banks and international institutions, maintained with RBI.

1.2.7. Rupee Debt Service

Rupee debt service includes principal repayments on account of civilian and non-civilian debt in respect of Rupee Payment Area (RPA) and interest payment thereof.

1.2.8. Other Capital

Other capital comprises mainly the leads and lags in export receipts. Other items included are funds held abroad, India’s subscription to international institutions, and quota payments to IMF.

- Current Account Balance = Net Exports + Net Invisibles

- Net exports = Value of Exports – Value of Imports = Balance of Trade

- Net Invisibles = Net services + Net Transfer Payments + Net income

- Capital Account Balance = External Assistance + ECBs + Short Term Debt + Banking capital (including Non-Resident Deposits) + Foreign Investments (Including FDI and Portfolio Investments) + Other Flows + errors and omissions

- Balance of Payments = Current Account Balance + Capital Account Balance(including errors and omissions)

Looking for help with balance of payment definition? Get Assignment Help from our online macroeconomics tutors to help with balance of payment formulas. Our online economics tutors will explain you all components of balance of payments and help you solve numerically balance of payments examples. Most students also confuse balance of trade with balance of payments and between concepts like balance of payment surplus and balance of payment deficit. A good reliable macroeconomics tutors like online economics experts from Assignmenthelp can help students clarify the concepts of balance of payments and explain the practical application and importance of balance of payments as well as real-word case studies based on balance of payment crisis.

BALANCE OF PAYMENT SUMMARY