Activity Base Costing Sample Assignment

Executive summary

The report is based on the benefits of activity based costing approach in the cost accounting. Cost accounting is the process of cost management of the organization by allocating the cost to various appropriates business or product line. The cost accounting process helps the company in managing and reducing the total cost of the company so that profit can be maximized. The Washington H. Soul Pattinson and Co. Ltd ha is an Australian company. The report contains corporate strategies of the company and use of the activity based costing in achieving its corporate strategies. The end part is the recommendation to the company for adoption of the activity based costing method.

Introduction

The activity based costing is an approach of costing used in the present condition. It is highly used costing approach which will distribute the total cost of the manufacturing unit on the basis activities and then product cost will be identified and only those cost of the activities will be added which are involved in the production of the product. In this assignment Washington H. Soul Pattinson and Co. Ltd is taken as targeted company and the advantages of the activity based costing are discussed keeping in mind the scope and objective of Washington H. Soul Pattinson and Co. Ltd. Further in the later part of this report there are some recommendations for the company to improve the costing method used by the company. An additional method apart from the activity based costing is given in the end part of the report which can also be used by the management of the organization along with the reason for its implementation.

Task 1

Activity Based Costing and Features

Activity based costing approach is based on the single principle of allocation of the total cost between the different products and services of the company on the basis of the services used by the different products in the manufacturing unit(Frazier, 2014). The activity based costing differentiates the cost into two parts one is short term variable cost and the other is long term variable cost. The short term variable cost of the company is distributed in this approach as per the cost drivers which are basically volume related such as direct labor hour, machine hours etc and the long term cost driver cannot be distributed immediately by the management as it is occurred as a result on long term production. The main features of the activity based costing are as follows:

- Cost driver are determined by the company after recognizing the different activities carried out by the company in manufacturing of the process.

- These cost drivers will than help in allocating the cost of the product or services offered by the company.

- The cost behavior patterns are properly distinguished from each other and separate cost driver is selected for each manufacturing activity.

- The cost driver of each production activity should be different and these could drivers are such that they are able give the correct information about the cost of production of the product.

- This activity based costing is helpful in allocating the overheads of the service departments which are used in the production process of the company and that are cannot be distinguished effectively(Fenn, 2015).

Task 2

Identification of the company’s mission and objective

Washington H. Soul Pattinson and Co. Ltd is an Australian company that has its shares listed on the Australian stock exchange. The company is engaged in different field of business and is achieving excellence in the respective field. Washington H. Soul Pattinson and Co. Ltd is not a company which wants to stick to one core business but wants to diversify the business by entering into many fields. At present the company is engaged in the business of natural resources, retail, building material, equity investment, agriculture, telecommunication and corporate advisory.

The objective of the company is to maintain a diversify portfolio of asset by the company. The equity shareholders of the company are the owners of the company and the main objective behind investing in the company is to earn a good return from the investment. Just like the others profit making companies in the market Washington H. Soul Pattinson and Co. Ltd is also in the line of earning a good return and then the return to be given back to owners of the company which are the shareholders of the company. The main focus is to maintain the proud history of the company and run towards a robust future waiting ahead.

Company’s corporate strategies

The main business of the Washington H. Soul Pattinson and Co. Ltd is the mining and natural gas extraction. Whereas the company also wants to run the other complementary business as well which are also in the profitable flow(Subramaniam, 2016). The company corporate strategy is to make the make the natural gas and mining business as the primary business and generate more profit from the primary business than supplementary business lines as they are expert in the mining and natural resources business. The corporate strategy also include differentiating between different business line so that profit can be allocated for them and if any business line is loss making than that should be eliminated from the business portfolio of the company.

The company should adopt a corporate strategy for cost reduction and differentiation. In this strategy the main objective of the company is to provide its product to the customers with least possible cost. The cost reduction can be easily done with the help of activity based costing. The cost if allocated properly than can be recognized that which product is produced from lower cost the available in the market. There will not be any hidden cost of any other product.

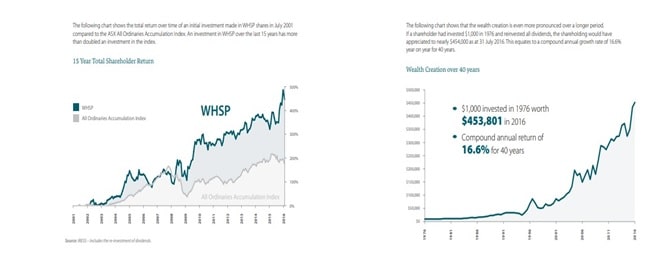

Graph: shareholder return and total wealth creation of the company over the years.

Source: annual report of the Washington H. Soul Pattinson and Co. Ltd for the year 2017.

Activity based costing helps in achieving the corporate strategies of the Washington H. Soul

Pattinson and Co. Ltd

The activity based costing is used by the management of the companies worldwide because it will help in better allocation of the service cost incurred in the production of product and services which are offered by the company. With the help of activity based costing management of company can identify the actual amount of cost incurred in manufacturing a particular line of product or offering a specific type of services. This way the management can identify the from different product offered by it that which product is the most profitable product and can rank the different line of products on the basis of the profitability. In case where company has limited labor hours or machine hours the management of the can choose to manufacture the product which more profitable to the company in spite of loss making or less profitable product. The activity based cost costing is a helpful tool in decision making of management(Dong, 2014).

The activity based costing is helpful in distributing the service cost of the company and not the material cost. Material cost generally easy to allocate for the different products of the company. Washington H. Soul Pattinson and Co. Ltd is a service providing company with different line of business. The service providing company has very difficult cost structure and the cost allocation is very difficult as the main cost is incurred in activities. For example is an administration cost is paid to the supervisory executive for supervising a number of stores in the country than it will be very difficult to allocate the cost paid to supervisor for the different stores which is very important if the individual profit of each store is required to be calculated. Therefore the activity based costing is very helpful in differencing the different services cost incurred by the company. In that case the supervisory cost will be distributed on the basis of a specific cost driver selected by the management which will accurately indicate the amount of work done by the supervisor to each store, like number of visit to the stores, or turnover of the different stores.

Task 3

The activity based costing is a near to accurate method of cost allocation but is a very complex method at the same time. The process to designing and implementing an effective activity based costing method is very difficult and expensive for the company. The implementation of the activity based costing is generally done in two processes. The manufacturing activity of every company is based on the cost driver according to which the cost will be allocated to each product. The cost driver will be selected carefully because the failure and success of the activity based costing depends totally upon the right selection of the accurate cost driver. The cost driver will be different for each manufacturing activity a single cost driver cannot be selected for all the manufacturing activity.

Now on the second step is to determine the recovery rate on the basis of the cost driver selected in the above steps this will be determined by keeping in mind the total number of cost driver in the financial period divide with the total cost incurred in the manufacturing activity in that very financial year. This recovery rate will be used by the management of the company to allocate the cost into different products produced by the company. In any product which is manufactured incurred specific number of cost drivers can be identified during the financial period taken and then these cost drivers will be multiplied with the recovery rate. This way the cost for that financial period can be allocated to every product(Keehan, 2015).

Task 4

As discussed above the activity based costing is near to accurate but costly method for the cost allocation. There certain other methods available which can be used to allocate the cost. One of the most common methods is the traditional method of costing. This method is easy to used very cheap to implement as it does not require any specific professional expertise in costing field. In traditional method of costing the manufacturing unit is divided into the production and service department and all the factory overheads incurred in the company while production were divided among these two departments. Now the overheads of the service departments will be distributed among the production department on the basis of the service given and finally than the recovery rate for the production department can be calculated which were used to calculate the production cost. This costing approach is good for the small companies which do not have any complex mixture of production and service department. The traditional approach is cheap and easy to use too therefore is widely used generally by small companies. Now if the product requires more work in service department and less material is used than the cost allocated will be very less as the recovery rate will be dependent upon the production department. And if any product does not require and service department work than the service department cost will also be included in the cost of the product because the service department overheads are included in the production department recovery rate(Zeng, 2014).

Conclusion

The report is based on the used and process of the activity based costing in the targeted company which is Washington H. Soul Pattinson and Co. Ltd. The above report proves that the activity based costing is giving more accurate result if the cost is allocated in the different product and the profitability of each product is to be assessed differently. Further the activity based costing improves the decision making of the company by providing accurate information about the productivity of the different product. However the activity based costing is very complex and expensive therefore not suitable for the small companies. Traditional method of costing will be more suitable for the small companies which is easy to implement and use and cheap also(Settanni, 2014).

References:

Fenn, B., Sangrasi, G.M., Puett, C., Trenouth, L. and Pietzsch, S., 2015. The REFANI Pakistan study—a cluster randomised controlled trial of the effectiveness and cost-effectiveness of cash-based transfer programmes on child nutrition status: study protocol. BMC public health, 15(1), p.1044.

Frazier, W.E., 2014. Metal additive manufacturing: a review. Journal of Materials Engineering and Performance, 23(6), pp.1917-1928.

Subramaniam, C. and Watson, M.W., 2016. Additional evidence on the sticky behavior of costs. In Advances in Management Accounting (pp. 275-305). Emerald Group Publishing Limited.

Dong, J., Liu, C. and Lin, Z., 2014. Charging infrastructure planning for promoting battery electric vehicles: An activity-based approach using multiday travel data. Transportation Research Part C: Emerging Technologies, 38, pp.44-55.

Keehan, S.P., Cuckler, G.A., Sisko, A.M., Madison, A.J., Smith, S.D., Stone, D.A., Poisal, J.A., Wolfe, C.J. and Lizonitz, J.M., 2015. National health expenditure projections, 2014–24: spending growth faster than recent trends. Health Affairs, 34(8), pp.1407-1417.

Zeng, X., McMahon, G.M., Brunelli, S.M., Bates, D.W. and Waikar, S.S., 2014. Incidence, outcomes, and comparisons across definitions of AKI in hospitalized individuals. Clinical Journal of the American Society of Nephrology, 9(1), pp.12-20.

Settanni, E., Newnes, L.B., Thenent, N.E., Parry, G. and Goh, Y.M., 2014. A through-life costing methodology for use in product–service-systems. International Journal of Production Economics, 153, pp.161-177.