Accounting Assignment Question with answer

E8-3 (Inventoriable Costs) Assume that in an annual audit of Harlowe Inc. at December 31, 2014, you find the following transactions near the closing date.

1. A special machine, fabricated to order for a customer, was finished and specifically segregated in the back part of the shipping room on December 31, 2014. The customer was billed on that date and the machine excluded from inventory although it was shipped on January 4, 2015.

2. Merchandise costing $2,800 was received on January 3, 2015, and the related purchase invoice recorded January 5. The invoice showed the shipment was made on December 29, 2014, f.o.b. destination.

3. A packing case containing a product costing $3,400 was standing in the shipping room when the physical inventory was taken. It was not included in the inventory because it was marked “Hold for shipping instructions.” Your investigation revealed that the customer’s order was dated December 18, 2014, but that the case was shipped and the customer billed on January 10, 2015. The product was a stock item of your client.

4. Merchandise received on January 6, 2015, costing $680 was entered in the purchase journal on January 7, 2015. The invoice showed shipment was made f.o.b. supplier’s warehouse on December 31, 2014. Because it was not on hand at December 31, it was not included in inventory.

5. Merchandise costing $720 was received on December 28, 2014, and the invoice was not recorded. You located it in the hands of the purchasing agent; it was marked “on consignment.”

Instructions

Assuming that each of the amounts is material, state whether the merchandise should be included in the client’s inventory, and give your reason for your decision on each item.

- It should include, since the ownership of the goods passes to customer only when it is shipped.

- It should not include, since it was not received yet.

- It should include, since it was not shipped to customer yet.

- It should include, since it was already received.

- It should not include, since it's the consignor's property.

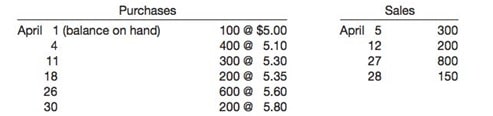

P8-4 (Compute FIFO, LIFO, and Average-Cost) Hull Company’s record of transactions concerning part X for the month of April was as follows.

Instructions

(a) Compute the inventory at April 30 on each of the following bases. Assume that perpetual inventory records are kept in units only. Carry unit costs to the nearest cent.

|

Purchases Total Units |

Sales Total Units | ||

|

April 1 (balance on hand) |

100 |

April 5 |

300 |

|

April 4 |

400 |

April 12 |

200 |

|

April 11 |

300 |

April 27 |

800 |

|

April 18 |

200 |

April 28 |

150 |

|

April 26 |

600 |

Total units |

1,450 |

|

April 30 |

200 | ||

|

Total units |

1,800 | ||

|

Total units sold |

1,450 | ||

|

Total units (ending inventory) |

350 | ||

1. First-in, first-out (FIFO).

|

Date of Invoice |

No. Units |

Unit Cost |

Total Cost |

|

April 30 |

200 |

$5.80 |

$1,160 |

|

April 26 |

150 |

5.60 |

840 |

|

$2,000 |

2. Last-in, first-out (LIFO).

|

Date of Invoice |

No. Units |

Unit Cost |

Total Cost |

|

April 1 |

100 |

$5.00 |

$ 500 |

|

April 4 |

250 |

5.10 |

1,275 |

|

$1,775 |

3. Average-cost.

|

Date of Invoice |

No. Units |

Unit Cost |

Total Cost |

|

April 1 |

100 |

$5.00 |

$ 500 |

|

April 4 |

400 |

5.10 |

2,040 |

|

April 11 |

300 |

5.30 |

1,590 |

|

April 18 |

200 |

5.35 |

1,070 |

|

April 26 |

600 |

5.60 |

3,360 |

|

April 30 |

200 |

5.80 |

1,160 |

|

Total Available |

1,800 |

$9,720 |

Average cost per unit = $9,720 ÷ 1,800 = $5.40.

Inventory, April 30 = 350 X $5.40 = $1,890.

(b) If the perpetual inventory record is kept in dollars, and costs are computed at the time of each withdrawal, what amount would be shown as ending inventory in (1), (2), and (3) above? (Carry average unit costs to four decimal places.)

For FIFO, the inventory would be the same in amount as in part (a), $2,000.

For LIFO, below:

|

Purchased |

Sold |

Balance* | ||||||

|

Date |

No. of units |

Unit cost |

No. of units |

Unit cost |

No. of units |

Unit cost |

Amount | |

|

April 1 |

100 |

$5.00 |

100 |

$5.00 |

$ 500 | |||

|

April 4 |

400 |

5.10 |

100 |

5.00 |

2,540 | |||

|

400 |

5.10 | |||||||

|

April 5 |

300 |

$5.10 |

100 |

5.00 |

1,010 | |||

|

100 |

5.10 | |||||||

|

April 11 |

300 |

5.30 |

100 |

5.00 | ||||

|

100 |

5.10 |

2,600 | ||||||

|

300 |

5.30 | |||||||

|

April 12 |

200 |

5.30 |

100 |

5.00 | ||||

|

100 |

5.10 |

1,540 | ||||||

|

100 |

5.30 | |||||||

|

April 18 |

200 |

5.35 |

100 |

5.00 | ||||

|

100 |

5.10 |

2,610 | ||||||

|

100 |

5.30 | |||||||

|

200 |

5.35 | |||||||

|

April 26 |

600 |

5.60 |

100 |

5.00 | ||||

|

100 |

5.10 | |||||||

|

100 |

5.30 |

5,970 | ||||||

|

200 |

5.35 | |||||||

|

600 |

5.60 | |||||||

|

April 27 |

600 @ |

5.60 | ||||||

|

800 |

200 @ |

5.35 | ||||||

|

100 |

5.00 |

1,540 | ||||||

|

100 |

5.10 | |||||||

|

100 |

5.30 | |||||||

|

April 28 |

100 @ |

5.30 |

100 |

5.00 |

755 | |||

|

150 |

50 @ |

5.10 |

50 |

5.10 | ||||

|

April 30 |

200 |

5.80 |

100 |

5.00 |

1,915 | |||

|

50 |

5.10 | |||||||

|

200 |

5.80 | |||||||

Inventory, April 30 is $1,915.

For the average-cost, below:

|

Purchased |

Sold |

Balance | |||||

|

Date |

No. of units |

Unit cost |

No. of units |

Unit cost |

No. of units |

Unit cost* |

Amount |

|

April 1 |

100 |

$5.00 |

100 |

$5.0000 |

$ 500.00 | ||

|

April 4 |

400 |

5.10 |

500 |

5.0800 |

2,540.00 | ||

|

April 5 |

300 |

$5.0800 |

200 |

5.0800 |

1,016.00 | ||

|

April 11 |

300 |

5.30 |

500 |

5.2120 |

2,606.00 | ||

|

April 12 |

200 |

5.2120 |

300 |

5.2120 |

1,563.60 | ||

|

April 18 |

200 |

5.35 |

500 |

5.2672 |

2,633.60 | ||

|

April 26 |

600 |

5.60 |

1,100 |

5.4487 |

5,993.57 | ||

|

April 27 |

800 |

5.4487 |

300 |

5.4487 |

1,634.61 | ||

|

April 28 |

150 |

5.4487 |

150 |

5.4487 |

817.30 | ||

|

April 30 |

200 |

5.80 |

350 |

5.6494 |

1,977.30 | ||

Inventory, April 30 is $1,977.30.

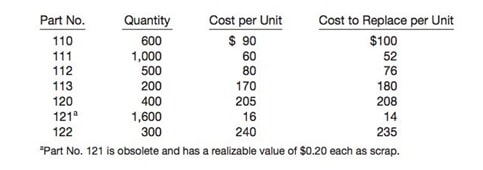

E9-1 (Lower-of-Cost-or-Market) The inventory of 3T Company on December 31, 2014, consists of the following items.

Instructions

(a) Determine the inventory as of December 31, 2014, by the lower-of-cost-or-market method, applying this method directly to each item.

|

Per Unit | ||||||

|

Part No. |

Quantity |

Cost |

Market |

Total Cost |

Total Market |

Lower-of-Cost-or-Market |

|

110 |

600 |

$90 |

$100.00 |

$ 54,000 |

$ 60,000 |

$ 54,000 |

|

111 |

1,000 |

60 |

52.00 |

60,000 |

52,000 |

52,000 |

|

112 |

500 |

80 |

76.00 |

40,000 |

38,000 |

38,000 |

|

113 |

200 |

170 |

180.00 |

34,000 |

36,000 |

34,000 |

|

120 |

400 |

205 |

208.00 |

82,000 |

83,200 |

82,000 |

|

121 |

1,600 |

16 |

0.20 |

25,600 |

320 |

320 |

|

122 |

300 |

240 |

235.00 |

72,000 |

70,500 |

70,500 |

|

Totals |

$367,600 |

$340,020 |

$330,820 | |||

The inventory as of December 31, 2014, by the lower-of-cost-or-market method $330,820.

(b) Determine the inventory by the lower-of-cost-or-market method, applying the method to the total of the inventory.

The inventory by the lower-of-cost-or-market method is $340,020.

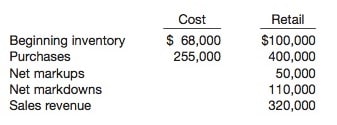

P9-12 (Retail, LIFO Retail, and Inventory Shortage) Late in 2011, Joan Seceda and four other investors took the chain of Becker Department Stores private, and the company has just completed its third year of operations under the ownership of the investment group. Andrea Selig, controller of Becker Department Stores, is in the process of preparing the year-end financial statements. Based on the preliminary financial statements, Seceda has expressed concern over inventory shortages, and she has asked Selig to determine whether an abnormal amount of theft and breakage has occurred. The accounting records of Becker Department Stores contain the following amounts on November 30, 2014, the end of the fiscal year.

According to the November 30, 2014, physical inventory, the actual inventory at retail is $115,000.

Instructions

(a) Describe the circumstances under which the retail inventory method would be applied and the advantages of using the retail inventory method.

This method is reasonable for this kind of company, since it has relatively low unit costs and that have a large volume of transactions. The advantages of the retail method in these circumstances include the following

- Interim physical inventories can be estimated.

- The retail method acts as a control as deviations from the physical count will have to be explained.

(b) Assuming that prices have been stable, calculate the value, at cost, of Becker Department Stores’ ending inventory using the last-in, first-out (LIFO) retail method. Be sure to furnish supporting calculations.

Becker Department Stores’ ending inventory value, at cost, is $83,000, calculated as follows:

|

Cost |

Retail | |

|

Beginning inventory |

$68,000 |

$100,000 |

|

Purchases |

$255,000 |

$400,000 |

|

Net markups |

50,000 | |

|

Net markdowns |

(110,000) | |

|

Net purchases |

$255,000 |

340,000 |

|

Goods available |

440,000 | |

|

Sales revenue |

(320,000) | |

|

Estimated ending inventory at retail |

$120,000 | |

|

Cost-to-retail percentage: $255,000 ÷ $340,000 = 75%. | ||

|

Beginning inventory layer |

$ 68,000 |

$100,000 |

|

Incremental increase | ||

|

At retail ($120,000 – $100,000) |

20,000 | |

|

At cost ($20,000 X 75%) |

15,000 | |

|

Estimated ending inventory at LIFO cost |

$ 83,000 |

$120,000 |

(c) Estimate the amount of shortage, at retail, that has occurred at Becker Department Stores during the year ended November 30, 2014.

The estimated shortage amount, at retail, for Becker Department Stores is $5,000 calculated as follows:

Estimated ending inventory at retail $120,000

Actual ending inventory at retail (115,000)

Estimated inventory shortage $ 5,000

(d) Complications in the retail method can be caused by such items as (1) freight-in costs, (2) purchase returns and allowances, (3) sales returns and allowances, and (4) employee discounts. Explain how each of these four special items is handled in the retail inventory method.

When using the retail inventory method, the four expenses and allow¬ances noted are treated in the following manner:

- Freight costs are added to the cost of purchases.

- Purchase returns are considered as reductions to both the cost price and the retail price. Purchase allowances are considered a reduction in cost price.

- Sales returns and allowances are subtracted as an adjustment to sales.

- Employee discounts are deducted from the retail column in a manner similar to sales. They are not considered in the cost-to-retail percentage because they do not reflect an overall change in the selling price.